The Alstom Owners Group (AOG) began in 2018 as a private user organization, enabling owners and operators of Alstom equipment to communicate directly with each other, collectively with the OEM, and with third-party service providers in a secure setting. The group meets annually and is scheduled for a late July meeting in Savannah for its 2024 jaunt.

AOG has grown dramatically since its founding. There were 41 members representing eight countries the first year. By the 2023 meeting, those numbers had increased to more than 200 members in three-dozen countries. Membership is limited to individuals directly involved in the construction, operation, and/or maintenance of Alstom gas and steam turbines and who are employed by companies with ownership and/or operational interest in those turbines.

Arnold Group, Hughes Technical Services (a division of AP4 Group), and Liburdi Turbine Services have supported the organization since its beginning, sponsoring each of the first six meetings.

The 2024 conference agenda, in development as CCJ goes to press is posted at www.aogusers.com, where you’ll also find registration, exhibiting, lodging, and other pertinent information. Contact ashley@aogusers.com with any questions.

Content for, and conduct of, AOG conferences is organized by a steering committee which has the following members for 2024:

- Kristi Gledhill, plant manager, Capital Power, Midland Cogeneration Venture.

- Ross Goessl, PE, senior engineer for We Energies.

- Paul Drake, plant manager of Tenaska Berkshire Power.

- Jeff Chapin, AOG founder; manager of business development for Liburdi Turbine Services.

- Chris Hutson, CSM-Gas Turbines, K-Machine Industrial Services.

For those familiar with the group, you’ll notice some changes to the committee as de facto end-user leaders MCV’s Brian Vokal and Tenaska’s Robert Bell have passed the torch onto their successors. Arnold Group’s Pierre Ansmann of Arnold Group dutifully served the committee for six years, and while still heavily involved with the organization, has welcomed back Chris Hutson, formerly of Southern Company now with K-Machine, back to the AOG leadership. Thanks to all for your dedication and advocacy for the group.

CCJ’s report on the sixth annual meeting follows.

Users convene

Jeff Chapin welcomed the group to EPRI’s offices and training facility in Charlotte (NC), Monday, Mar 20, 2023. Sessions would end on Thursday with a tour of the research organization’s labs and four concurrent training workshops.

Attendance on the first day was limited to owners and operators of Alstom equipment, with GE, the OEM of record, joining in the afternoon. Service providers were invited to participate for the remainder of the conference.

Chapin launched the meeting with one paramount appeal: “Network! We all struggle to find parts and services. Let’s work together and share information. We need to know our service providers, and they need to know us.”

This initiated a long discussion on personnel—not just GE’s or the service providers’, but the owners’ employees as well. And not just people as contacts; people who are willing to dig in and get things done.

With that, the meeting moved on to questions compiled during registration. Some were general: “Is there any successful peer/user repair experience on GT11 rotating blades using non-OEM shops?” Various responses followed with mention of Liburdi, TRS, and Doosan Turbomachinery Services—among others.

Some were more specific: “Any experience with GE-suggested borescope inspections on GT11N/GT11D Row 4 blades to address TIL-2376?” One response: These blades are difficult to see and assess. Side note by one: “We’ve had issues with parts repaired in Dubai shops, and it would be nice to know where replacement parts are coming from.”

The key parts decision that comes up, all agreed: Repair, or replace?

The dialog continued. Next: Supply scheduling for new parts, even if the order is placed 18 months before the need. All agreed that such timing can work, but there are still delays. Owners agreed that the best strategy would be 24 months for GE parts.

One owner noted that even paying a 25% expediting premium gives no timing guarantee. “Even our long-term service agreements (LTSAs) aren’t always helping us,” said more than one.

All concurred that supply-chain concerns are not new, nor have they improved. The consensus was to “maintain capital spares at site if you can,” but many reported restrictions with financial approvals (management) to do so. Many plants also have new or even multiple owners to complicate and delay the processes.

The consensus: Owners must be their own expediters into the supply chain, wherever the hold-up seems to occur.

An interesting point was made by one owner here: Check your parts warranties. Some carry one year after install, but some also state one and a half years from delivery. This is not consistent with the recommendation to carry critical spares in inventory.

Long-term planning has another obstacle. Operating profiles can change quickly, and when they do, unexpected pressures could be put on equipment.

For Alstom-specific issues, a few of the favorite non-OEM suppliers have good background within their management, but at times still need to look for specific experts for help. Many are also light on what the group called “bench strength.”

Consensus again: Finding the right person, and having bench strength, are concerns common to everyone, even GE. This raised two additional topics: First, owner/operators knowing the right people to call, and second, all companies in the industry needing to grow (or initiate) their apprentice programs for the longer term. “Succession planning is big for everyone,” was a key takeaway.

An owner noted that during a recent C-inspection, the OEM had worked into its QA/QC plan three-point alignment checks based on fleet incidents. What do others recommend? One answer: Three points is just a check. Six points is better.

Another interesting find: “We have found a problem with the original, OEM-installed combustion-enclosure roof hatch (Fig 1). The protection violates today’s OHSA code. It’s not something you look at often. We discovered it during a roofing project.”

Keep in mind that many of these discussions also occurred one-on-one or in smaller ad-hoc groups throughout the conference, and during the breaks and evenings. The posed questions acted as catalysts, and some came up during the presentations. To get the full benefit of the discussions, and to offer your input, the editors recommend being there in 2024—and beyond.

The AOG User Group Forum was mentioned often. For those interested, this online discussion feature is available to all registered members of AOG. This forum is a private online community of Alstom turbine owners to communicate directly and securely with each other. It is the online extension of the annual conference.

As noted earlier, membership is limited to individuals directly involved in the construction, operation, and/or maintenance of Alstom turbines and who are employed by companies with direct ownership and/or operational interest in those turbines. An account is required and can be obtained at https://forum.aogusers.com/login. Final slide decks for this conference are available to registered users through the Forum website.

GE Vernova

GE purchased Alstom’s gas and steam turbine/generator operations in 2015 and has had a scheduled session with owners at the annual conference, serving as OEM.

Stefano Tartoni, platform manager base fleet; Tom Stroud, GT24 product manager; and others from GE addressed the group on the afternoon of Day One, beginning with a breakdown of the current and changing GE structure.

Said GE to begin, “As a fleet equipment overview, the GT11N machine is seen as rugged, reliable, and relevant. With 30 years of operating experience, 80 out of 87 units remain in service.”

The GT11N2 fleet also has a 30-year history, an average age of 21 years, with 57 of 58 remaining in service globally, GE participants said.

For the GT24 fleet, said Stroud, 52 units have been installed globally since the mid-1990s, mostly in North America (including Mexico), averaging 5000 operating hours annually.

GE has issued and maintains Technical Information Letters (TILs) and Field Service Bulletins (SBs) on these fleets.

This led to brief technical updates on 11N Row 4 turbine-blade liberation (TIL-2376 issued), 11NM Row 3 blade liberation (SB issued), 11N2 TVC inset-ring improvements, and other specifics.

GT24

For the GT24, updates followed on Row 11 compressor-blade tip cracking, specific MXL2 upgrades, and others, including pulsation protection systems.

Rotor lifecycle management should focus on two areas, said GE: creep life and cycle life. A remaining-life program is available from GE that monitors operating hours (creep life) and fired starts (cycle life). The presenter dove into the details of each, ending with the thought that, with proper care, units should reach 200,000 EOH. Stressed was the need for “safety-critical inspections.”

After a short break, GE returned to discuss replacement parts and outage planning. A strong GE suggestion: “Outage planning should start 30 to 36 months before the outage,” recognizing that parts cycle times include material delivery, which itself can take up to 24 months.

GE does, however, carry an “emergency inventory” for forced outages. In fact, GE holds two inventories, new and refurbished, in Switzerland, they said.

Recognizing all global influences, the suggestion was: “Build your own inventory, and use GE to help.” (Note owner comment above on inventories and warranties.)

One important add-on: Parts from GE will include the “latest and greatest” design improvements which might not be available from other suppliers, the presenters suggested.

Josh Pryor gave an informative presentation on repairs in general, stressing that GE’s repair processes incorporate results of the company’s “continuous investment and improvement” programs, including in-depth research. “There is investment and development within GE for the fleets,” he said.

Another interesting point: Outage planning should include the latest tools developed for replacing the parts. Emergency repair cases handled by GE get passed through the company, he said, and become background for both current and future work—including the best tooling.

Then came an area where “GE is starting to pivot.” Seeing that more and more of the repair work is “condition based” (that is, stop/start), GE is focusing on how to help with “short return-to-service intervals.”

For generator support, GE is trying to qualify more American component suppliers to reduce import transportation and customs issues. But one difficult problem remains: There are relatively few “professional winders” and other skilled personnel within the industry pool.

For controls issues, GE has launched a program to help with Mark VIe systems.

Time was provided at the end for questions that included the items above plus the skills gap in field service teams (GE has a new mentorship program), concerns about current TILs and legacy SBs, a new generation of exciters, and benefits/drawbacks of three-point alignment.

Users, solutions providers

Day Two began with the steering committee’s Brian Vokal welcoming service providers to the conference. The first keynote address followed. EPRI’s Bobby Noble, program manager for gas-turbine R&D spoke to “How gas-turbine maintenance has changed.”

Explaining that EPRI is funded 40% internationally, Noble focused on two programs and covered products for the GT8, GT11N/N1/N2, GT13, and GT24/26. The specific programs:

- Program 216, Gas-turbine lifecycle management.

- Program 217, Gas-turbine advanced components and technologies.

Stressing that the industry must adapt to constant change, he first discussed innovation in combustion technologies, advanced manufacturing and repair, and use of digital twins.

One specific innovation is a GT24 combustion tuning guide and training program developed by EPRI. Another is GT26 firing-temperature verification, addressing the “pain points” of shortened intervals, advanced hot-gas-path degradation, and premature replacement of parts.

Talking about outage management and oversight, Noble highlighted the big issue faced by the industry: Personnel retirements and the need for knowledge capture. This was in line with the opening discussions by owners.

For the personnel issues, he saw three strategies: Emphasize knowledge capture, focus on documentation (and archives), and create a strong culture of collaboration.

Noble also offered a detail taken from the 7FA fleet. At one unit, outages had been performed for decades, but only recently did the site include mechanical cleaning of the turbine wheel serrations. Lack of this cleaning led to rotor replacement in another unit.

The second keynote, by Dave Hetherington of McCoy Power Reports, Richmond, Va, covered “Alstom GT fleet behavior: GT24 and GT11.”

He looked at data for units above 20-MW capacity, listing the Alstom USA fleet as:

- GT11 combined cycle, 24 units; simple cycle, 65.

- GT24 combined cycle, 24 units; simple cycle, 3.

Hetherington’s long-term trends looked at fired-unit count, gross load, operating time, fleet heat rates and starts/stops for 2003 through 2022, and starts/stops for 2015 through 2022. For the last, GT24 has had the largest continuous trend in load and start/stop increases.

He then reviewed this within the context of ongoing global generation mixes and trends.

User presentation: Rocksavage

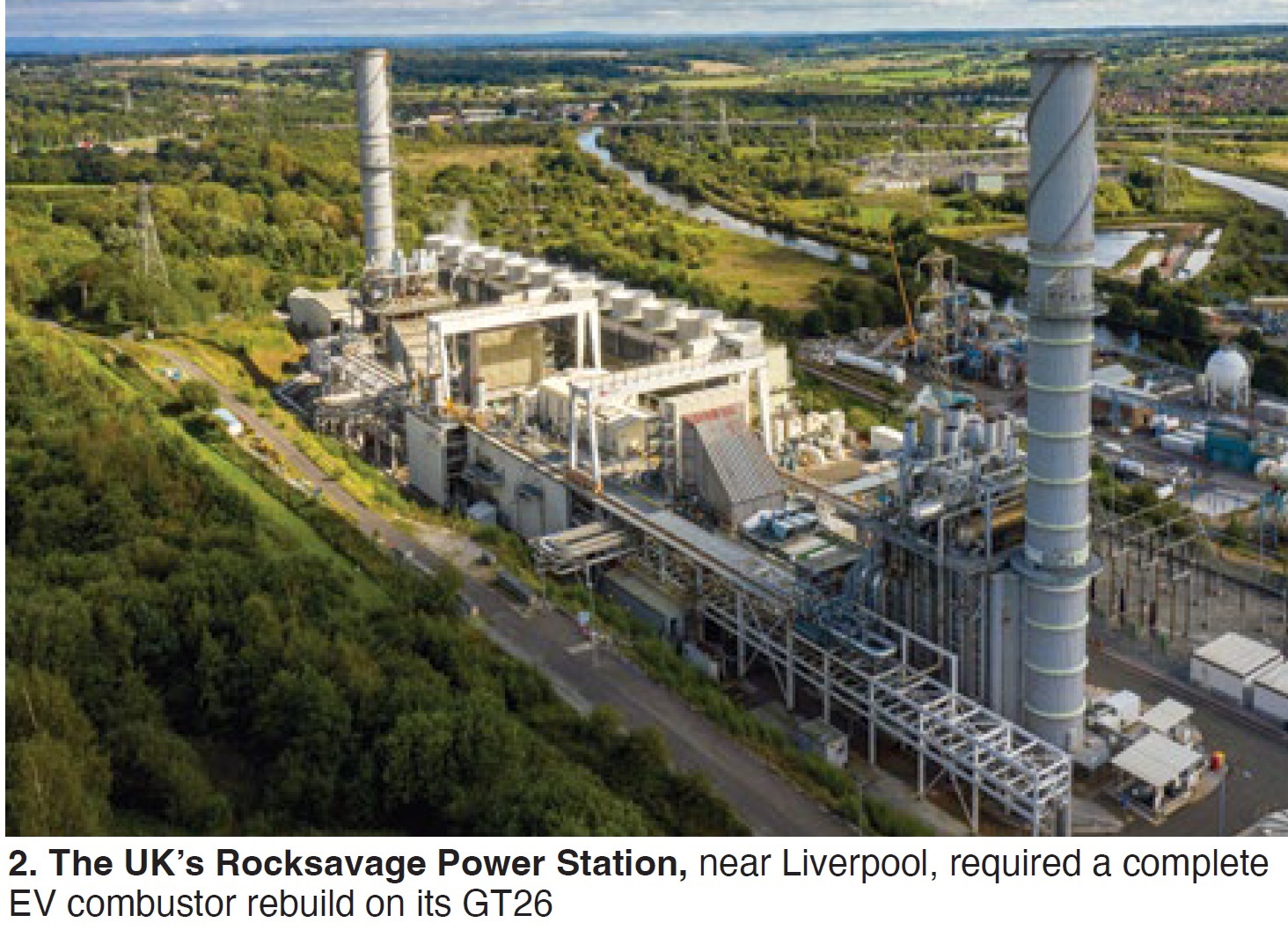

Alstom equipment owner, InterGen UK, described a significant GT8 EV combustor failure in May 2022 that shut down Rocksavage Power Station’s gas-turbine B. Speaker Paul Swire labeled this a “rebuild project” with a “truly pragmatic solution.”

Rocksavage is a 2 × 1 800-MW, fully merchant combined cycle firing natural gas. It is located in the northwest of England near Liverpool. Commercial operation of the GT26 A/B version machines began in 1998 (Fig 2).

There are no OEM service agreements in place.

Gas-turbine B’s failure, calling for a complete EV combustor rebuild, occurred on May 21. The plant’s dedicated service provider was contacted and disassembly began on July 25. The GT was disassembled and assessments completed by August 25. Initial findings showed severe damage to the EV combustion chamber, lance trumpet, hood rear wall, and burners (Fig 3).

The unit was back online for the high-market-value winter months.

Challenges. There are very few GT26 A/B units operating worldwide and InterGen owns the majority—four. The OEM’s stock of EV combustor parts for the A/B model is very limited.

To replace the EV combustor structure with new equipment from the OEM a 46-week lead time (to April 2023) was quoted. It was outage season and OEM resources were said to be stretched because of prior commitments. With that schedule, a return to service would be June 2023.

Solution. InterGen engaged with independent power-generation owners, GT consultants, and various service companies. They contacted the engineering teams of other GT26 A/B owner/operators worldwide and worked with the OEM to explore options.

Through this collection of resources, parts began arriving at site October 4 and the EV combustor rebuild began October 6. Some original pre-owned parts, critical to the project, were located at a GT26 A/B site in Argentina. Others were made by third-party providers, as well as the OEM.

The GT rebuild was completed in November with first synch November 24, and return to commercial service December 6. InterGen has “confidence” in running through to the 2024 Major Inspection. This rebuild approach beat the assumed OEM schedule by six months.

Mechanical Dynamics and Analysis

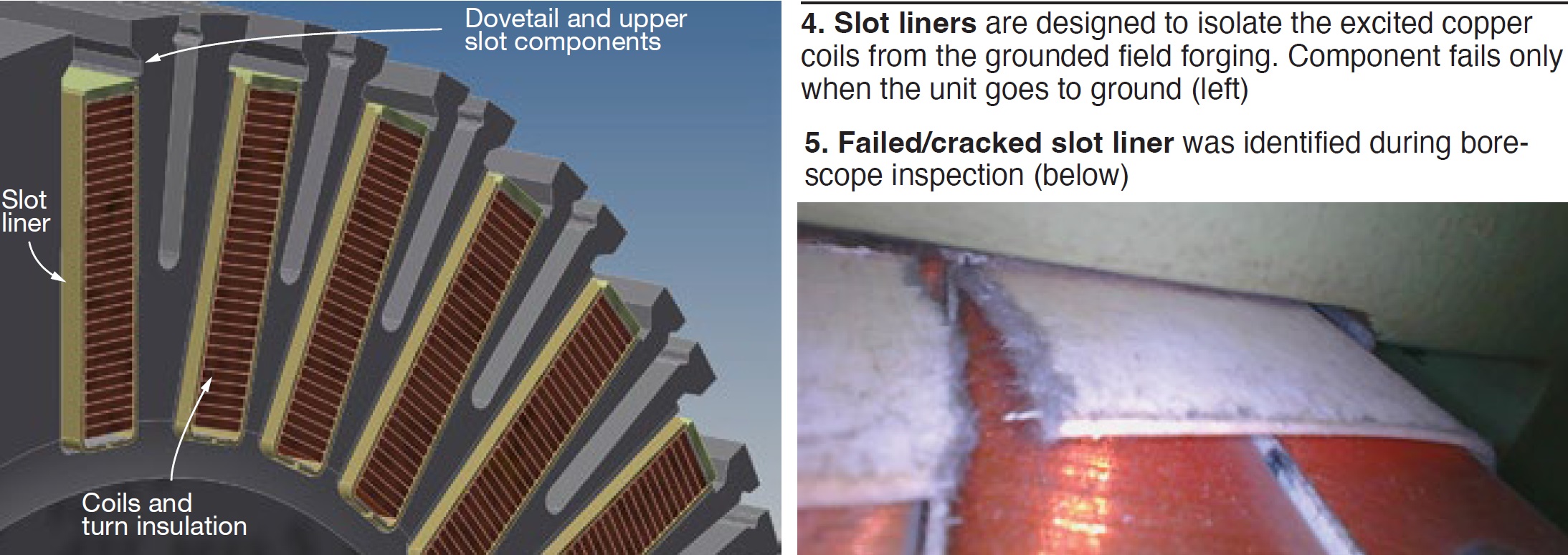

Next, James Joyce, MD&A’s generator services operations manager, launched the service-provider’s portion of the program with his presentation on “Slot liner cracking,” focusing on Alstom generator fields.

Slot liners, which fail only when the unit goes to ground, are designed to isolate the excited copper coils from the grounded field forging. There are both U- and L-style liners.

The U-style in this example was experiencing pin holes and cracking. Explained Joyce, the U-style hugs the coil very tightly, and “does not have any tangential relief.” The L-style on other units has a centerline break and can move slightly. The U-style has no centerline break causing all tangential forces to be applied to both sides of the U channel (Fig 4).

Liners can be inspected by borescope during a minor outage (Fig 5).

In the case study presented, the unit had passed electrical testing. But inspection found a problem and potential for grounding. The owner/operator chose replacement. These liners can be replaced after removing the upper slot components in a single-coil rewind (Fig 6).

Joyce concluded by describing a high-speed balance and heat run by MD&A in its St. Louis shop.

K-Machine

K-Machine Industrial Services presented its profile of turbine services for utilities. This is a family-owned company in Savannah (Ga) that focuses on portable machining and welding, component manufacturing, and valve parts and refurbishment. Its gas-turbine focus includes exhaust frames and diffusers, diaphragm manufacture and repair, casing crack repair, and thermal re-rounding (shell and casing distortion correction).

K-Machine also manufactures selected OEM replacement parts.

Hughes Technical Services

A division of the expanding AP4 Group, which includes AP+M, Turbine Controls and Excitation Group, and Gas Turbine Controls Corp, HTS contributes expertise on powerplant commissioning and maintenance. It was founded in 2014 by former ABB/Alstom engineers and others in the industry, including GE.

HTS is “the primary third-party provider of Alstom parts refurbishment service in North America” in close cooperation with TRS (see profile below) and others, said Gary Hughes (Fig 7).

For gas turbine A, B, and C inspections the focus is turnkey—including tools, craft, technical advisors, and commissioning. Inspection and maintenance capabilities make for a long list, together with steam-turbine services and upgrades.

HTS also listed its in-house controls expertise and upgrades—including an ABB Value Provider Program. Add to that, the company’s flame monitoring systems, pulsations monitoring, and balance-of-plant capabilities.

Arnold Group

The company’s Pierre Ansmann focused on industry response to changing market conditions—including:

- Improved dispatch appeal.

- Reduced startup times.

- Reduced plant cycling stresses on single-point-of-failure assets.

Ansmann then explained the company’s three key targets:

- Steam turbine warming.

- HRSG warming.

- Steam valve maintenance.

Steam-turbine warming systems can significantly reduce startup time. In a D11 case study, total plant optimization was reduced from 266 to 149 min, and the HP rotor life-consumption factor was reduced by approximately 25%. There were also lower overall steam-turbine stresses because temperatures never dropped below 300F. Upper-to-lower casing temperature differentials were also reduced.

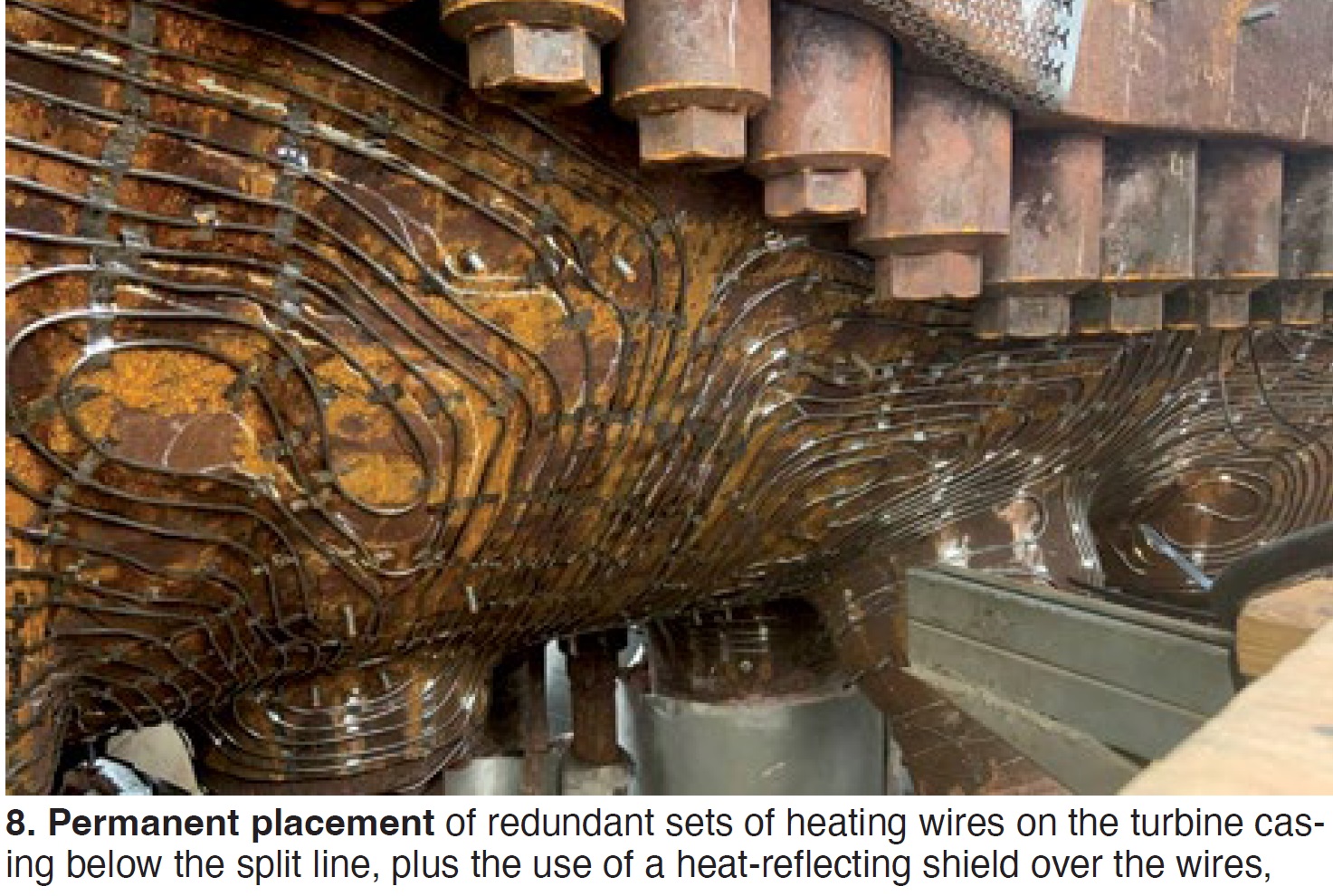

The D11 example given includes direct permanent fixing of heating wires below the split line (Fig 8). The unit has removable heating panels on the split line and upper casing.

Ansmann explained the “single layer insulation and turbine warming system” that offers “the most advanced turbine insulation combined with a high-performance heating system.” To dig deeper, see this informative article.

Liburdi Turbine Services

Dave Nagy discussed “Gas turbine supply-chain challenges: Component repair to reduce waste and improve turn time.”

“Materials are finite,” he said, “and there is high global competition for raw materials used to make gas-turbine components.” Most components have up to 60% nickel and 10% cobalt, although these numbers vary.

Nickel is in high demand for electric vehicles. Cobalt is another limited resource, and demand is about to outpace supply as some gas-turbine components have moved to around 60% cobalt.

The outcomes: Longer lead times and increased replacement-part costs, leading to “operational uncertainty.”

There is also increasing use of the term “yield.” For example, can someone repair a component to yield a 75% chance of making it to the next major outage (or similar milestone)?

Suppliers are no longer stocking spares, and global supply chains are subject to disruptions (nature, politics, economy, cyber attacks). Ongoing forced outages also contribute to inventory reduction.

Nagy offered a brief history of “R” terms. In the mid and late 1990s, many corporations turned to the Three Rs of “reuse, reduce, and recycle.” These are in play today. But now we are adding rejuvenate.

Nagy took attendees back to the company’s founder, Joe Liburdi, at the sixth ASME Turbomachinery Symposium in 1977 and his paper on rejuvenation of used turbine blades by hot isostatic pressing. Liburdi was with Westinghouse Canada at the time.

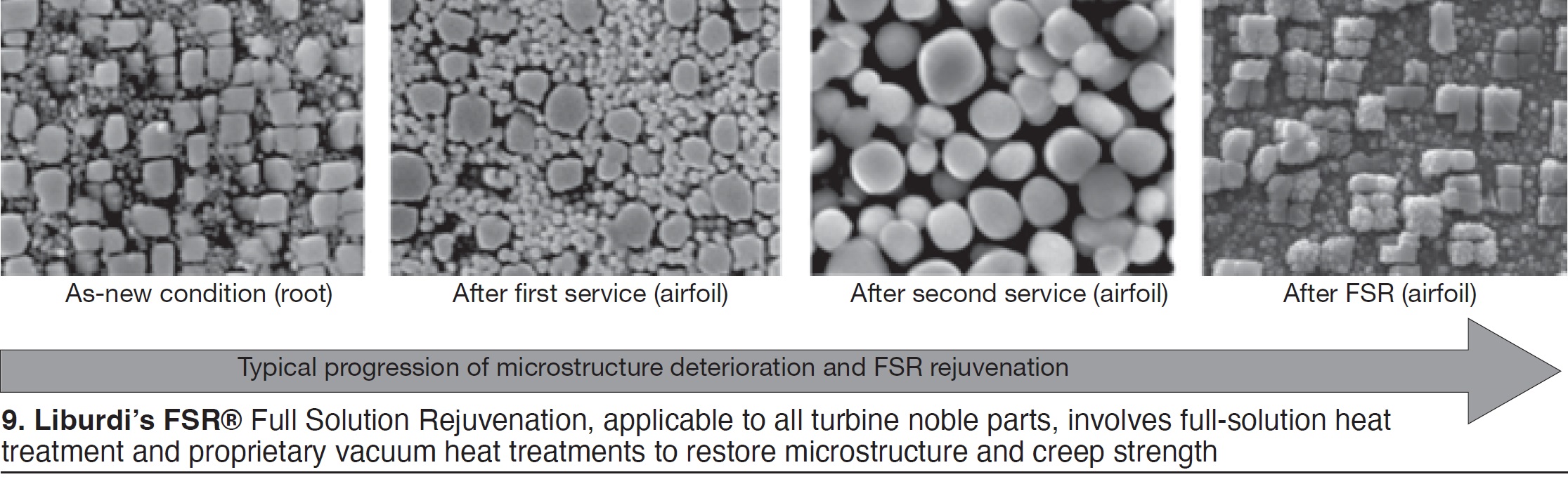

Liburdi as a company is now talking about FSR® or Full Solution Rejuvenation (Fig 9), meaning:

- Full solution heat treatment (not partial).

- Proprietary vacuum heat treatments.

- Restoration of microstructure and creep strength.

- Applicability to all turbine noble parts.

Two points about FSR:

- The processed part must meet or exceed new-part strength requirements, and

- The process can be repeated at each service interval.

Nagy offered a mechanical proof test showing stress-rupture test results to make the point.

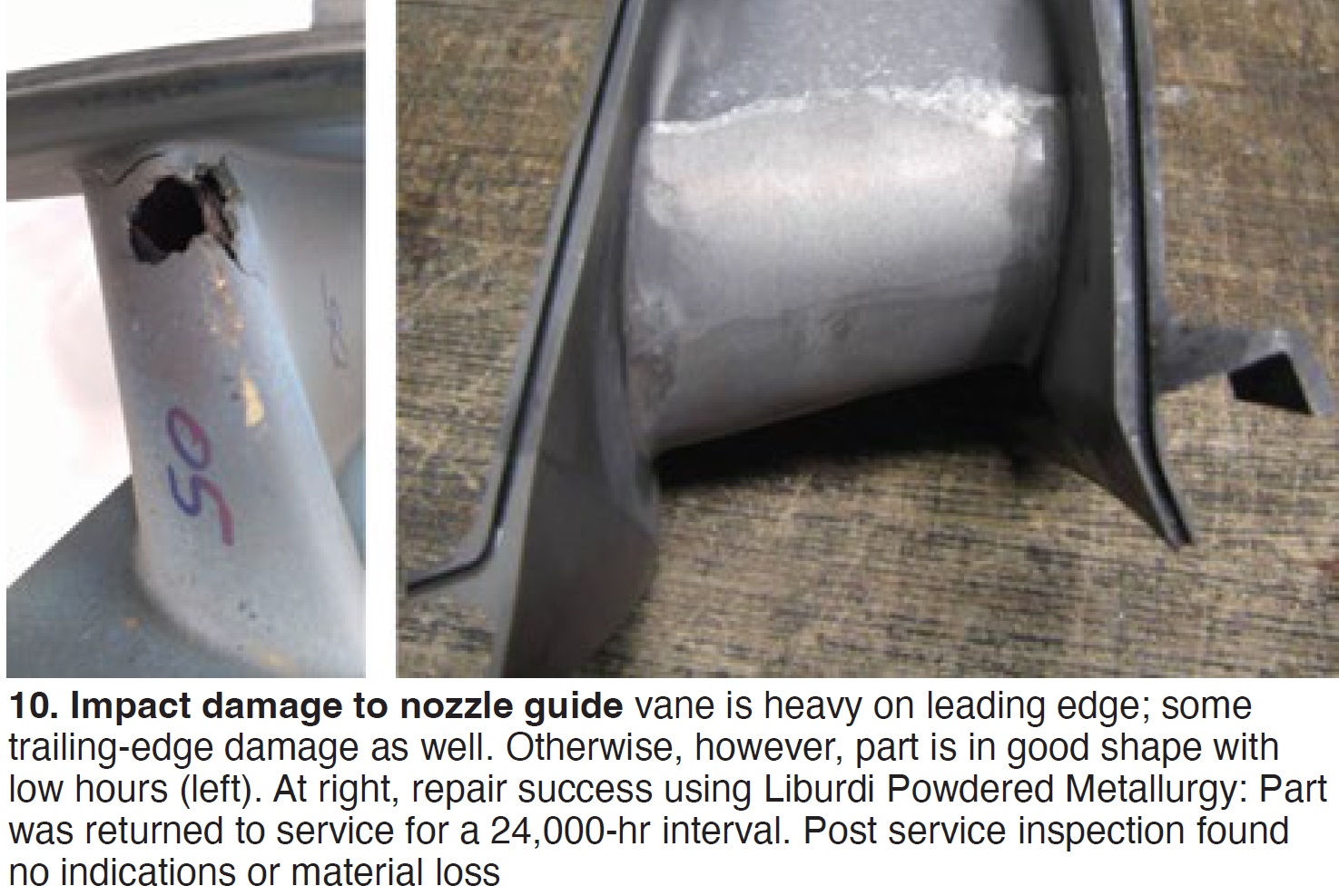

The fifth “R” is reconstruction. His example: Impact-damaged nozzle guide vanes with leading-edge damage (Fig 10). The leading edge was repaired using Liburdi’s LPM metal replacement technique—a powdered metallurgy technology. The part was returned to service for a full 24,000-hr interval. Post-service inspection found no indications or material loss.

Questions followed about use of this technology for other parts. Nagy gave examples, and said capabilities can include the combustion section. LPM can be used for both rotating and stationary components, being mindful of pressure limits.

Allied Power Group

Richard Curtis focused on APG’s service and maintenance options for the GT11D5/N/N1 fleet— noting technical, shop, and field resources available for scheduled maintenance, component life extension, and durability improvements.

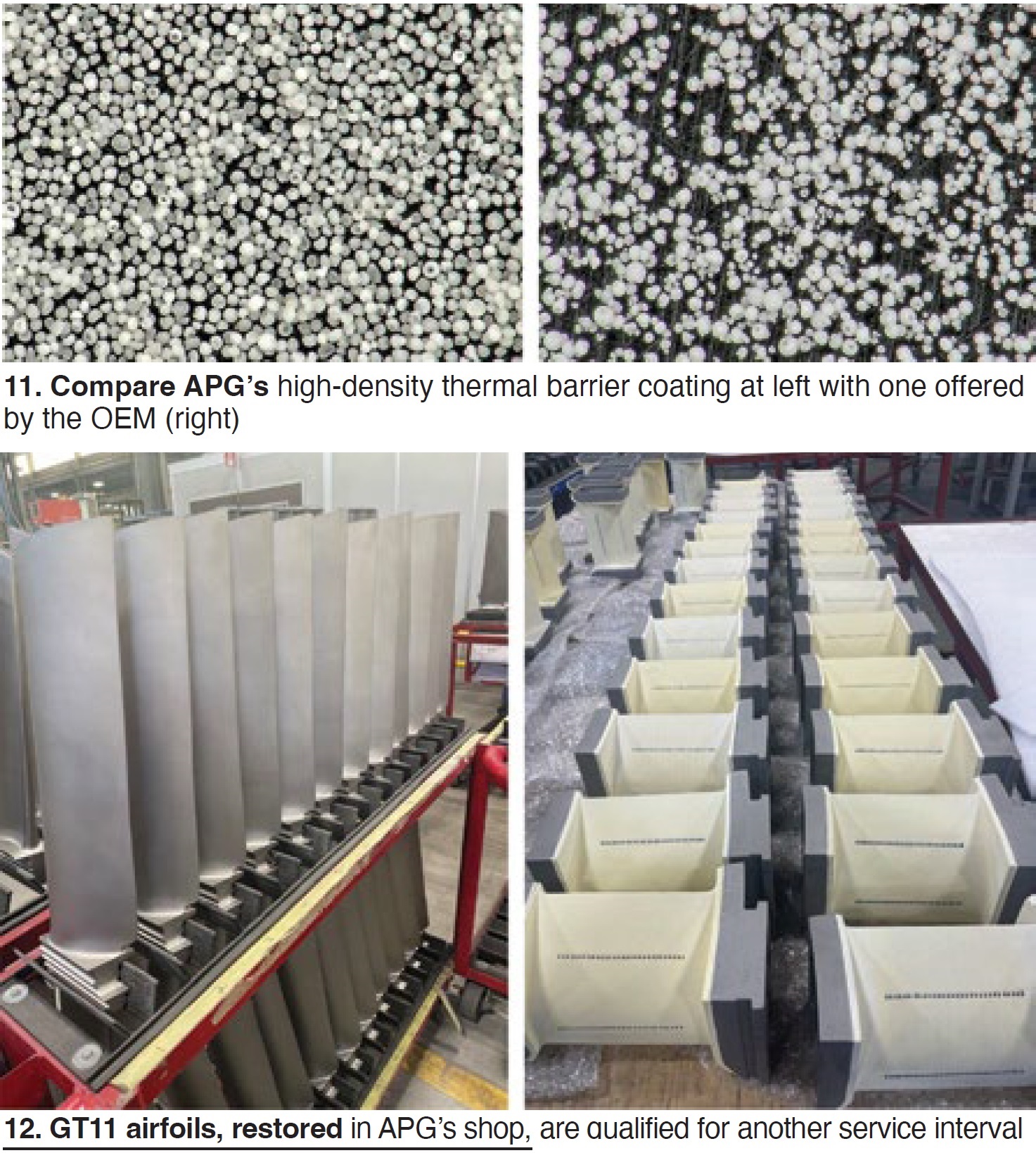

He first explained superalloy and thermal-barrier-coating capabilities, comparing APG’s coating powder to that offered by OEM (Fig 11). The APG HD-TBC is applied generally with >95%-97% density, and up to 20 vertical cracks per linear inch depending on application, as applied to buckets/blades, nozzles, and shroud tiles.

Curtis turned to APG parts, repairs, and field activities. Recent jobs specific to GT11 were varied, including rotor inspection and repair. Component-specific examples were the combustor—including upper inserts, tile carrier rings, tiles, lower inserts, U-duct inner liners, and hot-gas casing.

GT11 turbine airfoil repair (Fig 12) includes coating removal/stripping, weld/braze repair of defects, wall-thickness restoration, rejuvenation heat treatments, dimensional restoration, and advanced coatings.

Curtis also covered turbine vane carriers, new capital spares, and replacement parts.

He added field service for minor and major inspections. Examples included major reconditioning for a GT11 exhaust-gas housing. APG is also deeply involved in a G11D5 hydrogen-firing feasibility study.

When asked about burner/swirler components, Curtis noted that diffusion-burner testing is a current APG activity.

Nord-Lock Group

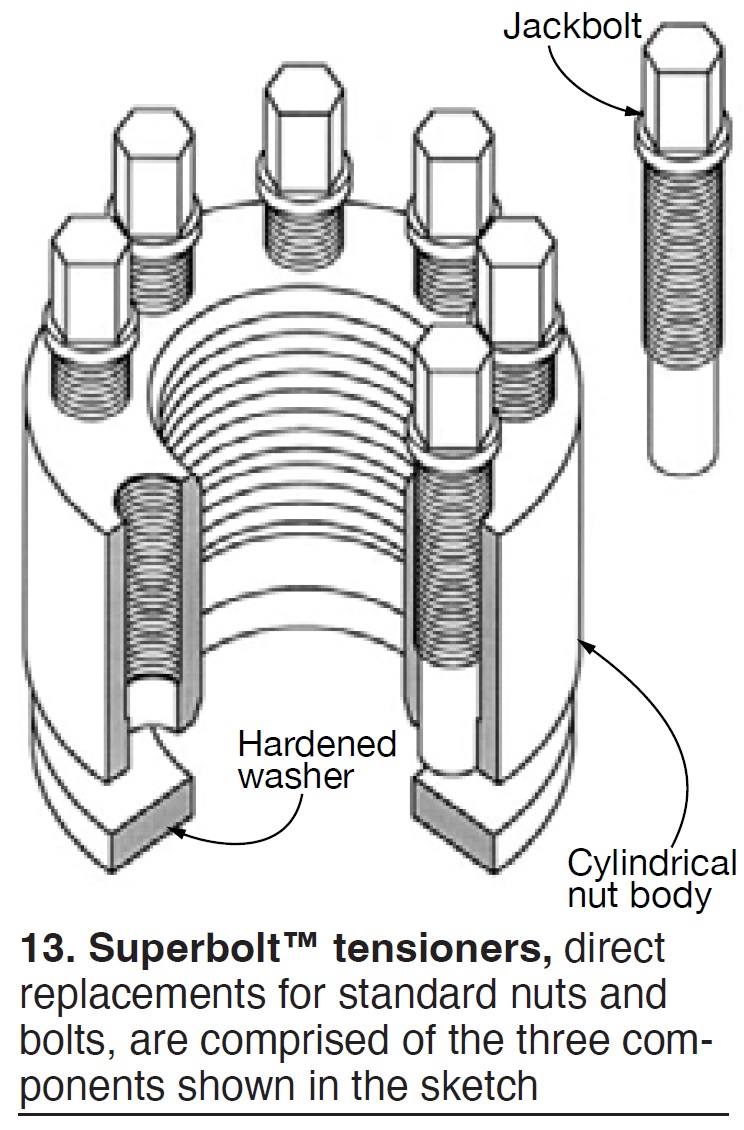

Juhani Karhatsu’s presentation began with wedge-locking washer technology and moved on to Superbolt™, Boltight™, EzFit (fossil) and HyFit (nuclear). Superbolt is a replacement for standard nuts and bolts (Fig 13).

Boltight is a hydraulic tensioning system for the power industry and others. His example was turbine casings. EzFit and HyFit are expansion bolts designed to improve coupling maintenance efficiency, used largely in fossil and nuclear installations.

Advanced Valve Solutions

Advanced Valve addressed two major cooling systems, which are difficult to control properly:

- Steam attemperation.

- Turbine-blade cooling (OTC).

Jeroen Bakker walked through HRSG attemperation, highlighting the first steam-cooled units installed in 2012 at the UK’s Marchwood Power Station. The design features a steam-cooled sleeve and these attemperators, designed to eliminate thermodynamic stresses, are still in operation after more than 2250 stop/start cycles.

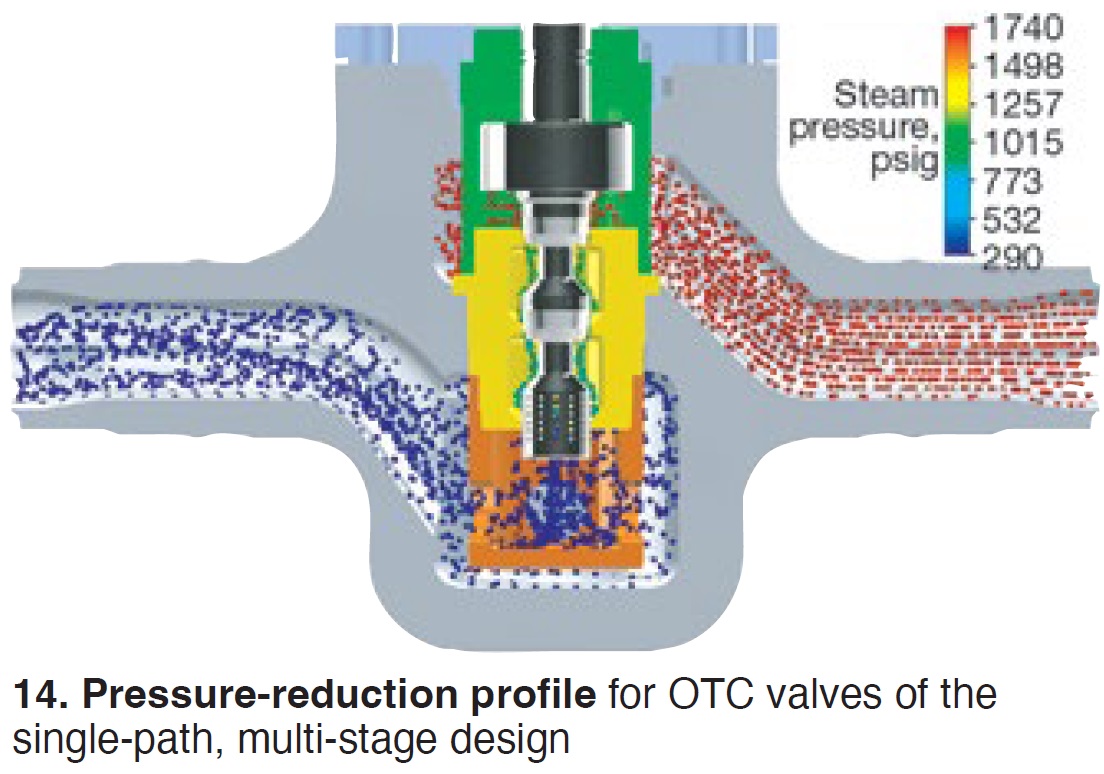

He then turned to GT24/26 OTC valves, providing cooled compressor air to protect the gas turbine’s first two stator rows and the combustion chamber. A major problem with OTC valves is cavitation.

Bakker offered the single-path, multi-stage solution working on the pressure-reduction principle (Fig 14).

Doosan Turbomachinery Services

The company’s Houston (Tex) team presented a case study on GT11NM rotor lifetime evaluation (LTE) and repair. Doosan provides gas- and steam-turbine component and rotor repair, heavy mechanical work, new parts, and onsite services. Welded rotor capabilities (Fig 15) include reverse engineering (including metallurgical), lifetime analysis, and new rotor supply (including balance).

Dr Scott Keller, director of engineering, first focused on rotor inspections, stating that Doosan can offer an outline for rotor inspection and unit management (rotor-life process map).

In-shop inspections shown in the case study included visual and diameter, cleaning, runout, incoming balance, and NDE and metallurgical evaluations. LTE findings included hardness, magnetic particle, ultrasonic, and eddy current.

He then turned to rotor repair based on customer targets of additional 115,000 hours and 800 starts. Analytical evaluation focused on three main areas:

- Creep damage/accumulation.

- Radiant heat shield indication repair.

- L-bore modification (details presented).

One attendee asked if Doosan got involved with the insurer. The answer was “yes,” working with the customer. Doosan is willing to discuss its data and methods.

AIM Power Consulting

Craig Nicholson offered a firing-temperature validation case study. Basically, he said that the inlet temperature of a gas turbine is an OEM-generated calculation that is put into the control system to optimize performance. However, this does not mean that the firing temperature is optimized.

That drove a detailed discussion of thermodynamics and conventional energy-balance calculations. Nicholson suggests an energy- and mass-balance approach as the most accurate.

With that, he presented a case study, an EPRI project, on a GT26 unit.

“Pain points” on the unit are shortened intervals, advanced hot-gas-path degradation, and premature replacement of parts.

Key performance indicators were determined for the high- and low-pressure expander sections, and for the compressor. Performance opportunities became the following:

- Under-firing LP turbine during dry operation.

- Under-firing HP turbine during wet operation (high fogging on).

- Adjustments to cooling-air flows to mitigate excess LP cooling air, bypassing the HP section as well as increasing cooling-air leakage at the platform of LP Row 1.

Detailed recommendations followed, with a summary that “Analysis provides the owner with a true engine baseline with tangible actions to optimize the unit and mitigate risk.”

AGT Services

The editors saw this presentation (and one later by National Electric Coil) as a wake-up call. A key point: Generators are sometimes last in line for inspection and maintenance. Jamie Clark made this point clear with his title slide: “Are you abusing your generators?”

Generators suffer abuse, just like other parts of the plant, caused by actions and events such as the following:

- Start/stops.

- Shifts in outage planning or scope.

- Grid events and influences.

Clark offered some ideas on how to cope with limited inspection and maintenance budgets, including these:

- Replace field-out majors with field-in minors.

- Use robotics and borescopes.

Both the stator and field are impacted by mechanical and thermal forces, he continued, urging attendees to keep in mind that most problems with generators are mechanical in nature (Fig 16). The generator is put together primarily by hand and problems often are found in bolted and brazed areas.

Clark made a point that “Around 75% of combined cycle starts run less than 24 hours.” Also, some generators are not well instrumented (monitored). He therefore suggested that plants have critical spares (field, stator bars, etc) available or know where to get them. Also have a plan for bushings, fuses, diodes, etc.

His conclusions:

- Get your unit’s baseline condition correct now, even if it means taking a Major Inspection to do it.

- Going forward, consider robotic inspections in lieu of field removal.

- Significant changes (increases) in operating duty warrant shorter outage intervals.

- Compared to prior outages, recent findings confirm that the most involved repairs are caused by cycling.

- All OEM bulletins are significantly more important when cycling.

- Some units are suffering common problems. Talk to people in the know. Most likely you’ll find them at meetings of the various industry users groups—like AOG, Generator Users Group, etc—where sharing experiences is part of the attendee culture.

Groome Industrial’s KinetiClean

Matt Cohen discussed the KinetiClean HRSG tube cleaning technology by Groome Industrial Service Group. This technology came to Groome through its purchase of ExPro in 2021 and is an alternative technology to dry ice blasting, also used by Groome.

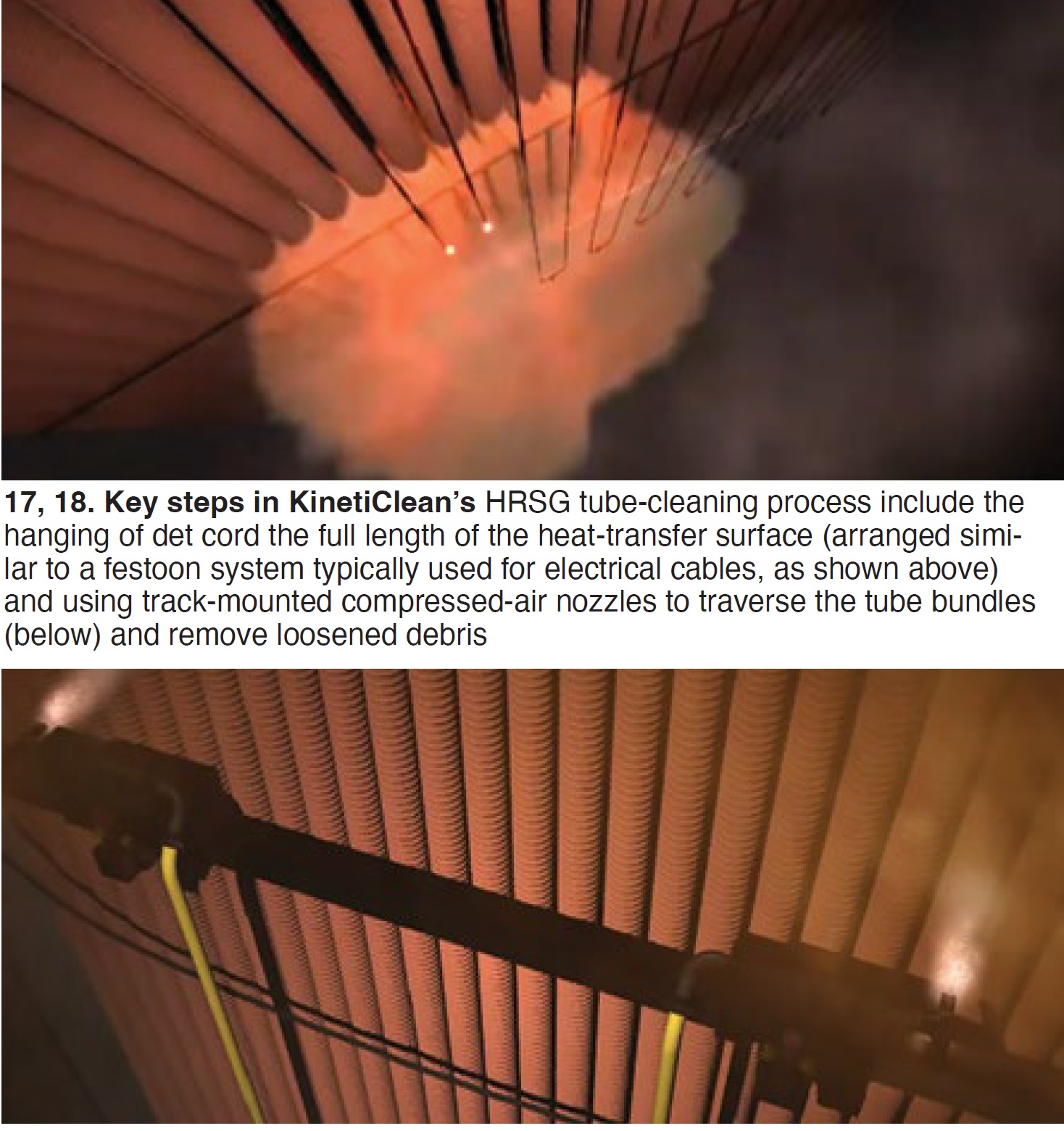

KinetiClean is a three-step process involving: (1) kinetic shockwaves from a det-cord system (Fig 17), (2) an automated high-pressure, high-volume air distribution system to release debris trapped between adjacent fins (Fig 18), and (3) debris removal. Det-cord is a flexible linear explosive with a core of PETN encased in a textile jacket. Multiple tube faces are cleaned simultaneously. No scaffolding is required.

The case study presented was for a Vogt HRSG in the Northeast. Previous dry-ice blasting had reduced pressure drop by 2 in. H₂O. After using KinetiClean in the next cleaning cycle, pressure drop decreased by 3.6 in. Nearly 4 tons of dry debris was removed.

Groome has completed a detailed study with EPRI on the tube-cleaning effects, tube impact, and safety of KinetiClean. The study is available through the EPRI Boiler Reliability group.

Said Cohen, this process also increases the HRSG outlet temperature for the steam turbine.

He was questioned on explosive permits, and said that Groome is licensed in most states, parts of Mexico, and the Caribbean. Another question was blast noise level, which Cohen described as “underwhelming.”

Emerson Automation

Emerson focused on control-system upgrades for Alstom GT series gas turbines: master controller, closed and open loop controller, protection, HMI layer and engineering station, and high-speed logging, all using the Advant system.

Advant component upgrades were shown for both plant and steam-turbine controls.

Emerson’s overall system for combined-cycle applications is called the Ovation Distributed Control System.

Camfil

Tom Carter reviewed filters and their impact on plant efficiency.

Over time, he said, the dust holding (loading) of filters increases inlet pressure drop leading to more compressor work, less GT output, and higher GT heat rate. He offered selected site examples of power loss attributed to filter fouling, then listed various filter classes and efficiencies.

Carter also discussed inlet-system modifications to reduce pressure drop as well as Camfil’s Life-Cycle-Cost (LCC) software.

National Electric Coil

Howard Moudy, director of operations at National Electric Coil, discussed “Lifecycle planning for aging generators.” He explained that a typical generator lifespan for planning is 30 years, but there are other criteria: hours, cycles, bulletins, and model history.

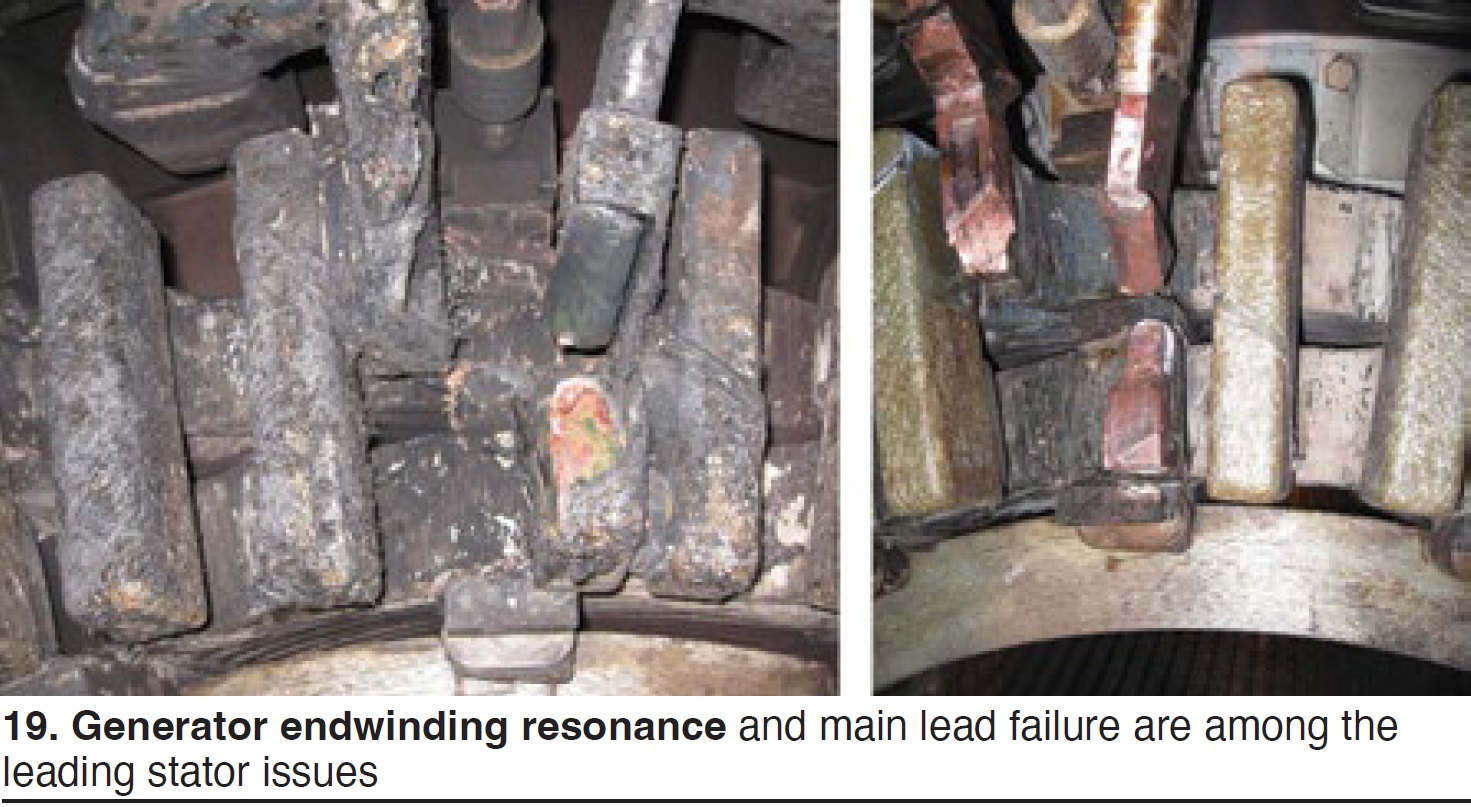

Primary generator stator issues are:

- Endwinding resonance.

- Main lead failure.

- Endwinding support system looseness.

- Spark erosion.

- Partial discharge.

Primary rotor/field concerns are:

- Pole-to-pole crossover (TIL-2119).

- Collapse of top-turn hollow conductor and deformation.

- Slot liner cracking—top-cap interface (TIL-2256).

- Damper winding damage.

- Coil saddle connections/braze joints.

Moudy used Fig 19 to illustrate the consequences of endwinding resonance and main lead failure. This unit shown had run for 18 months and two weeks. The warranty period was 18 months.

He then reviewed bump-test methods, vibration, resonance, spark erosion (common on machines without side ripple filler), and partial discharge (common in most high-voltage air-cooled generators).

Pole-to-pole crossover failures, Moudy continued, usually are caused by one or a combination of design, material, or workmanship. The primary contributor is lack of flexibility, and this has a strong correlation to operating cycles.

He offered examples of collapsed top turns, slot-liner cracking (review MD&A comments above) and damper alignment finger liberation. He added a suggestion for new, upgraded zirconium-copper alloy damper segments with no braze joints.

Moudy then discussed the end-of-life period on the traditional lifecycle bathtub curve.

On the topic of new copper versus old, Moudy asked about two pennies, one new and one old: Which one has more value? It’s not about appearance, he said, rather use and re-use can decrease reliability because of multiple heat/braze cycles, and there can be cycling fatigue depending on service.

Upgraded saddle braze joints can allow better column air flow, minimize air-inlet distortion, offer better control of process brazing, and help preserve the copper base in subsequent heat/braze cycles.

For stator rewinds, coil supply is critical, as is coil specification, he said. And as a general principle, basic materials and properties change every 10 years or so. Side note: National Electric Coil has its own roller mill and makes its own copper in Brownsville, Tex.

High-quality coil manufacturing requires a large investment. Robotic taping is a sign of quality, as are autoclaves (vacuum pressure impregnation systems). VPI improves heat transfer.

According to Moudy, some resin-rich processes, new to the market, look attractive with good quality characteristics. But below the surface, coils produced with these processes do not have the technical qualities that ensure good performance and long-term reliable operation.

When asked about cycling’s impact, Moudy said that, in general, speed change has the greatest impact on the rotor. Load change has more impact on the stator (temperature changes, etc).

TRS Services

Matt Sokol and Charlie Wood presented on case-study repairs to GT11 and GT13 components—including hot-gas casings, vanes, and vane carriers. TRS works closely with Hughes Technical Services (HTS) to provide a comprehensive non-OEM Alstom repair and maintenance alternative.

The company has built its own furnace box capable of heat treating a 13DM hot-gas casing assembled to a heat-treat fixture and capable of withstanding temperatures of up to 2300F.

Sample jobs completed or in process were 11N2 hot-gas casing, 11NM components including vanes and blades, and 13DM vanes, blades, and casings.

Common issues seen and repaired for hot-gas casings are:

- Panel distortion.

- Wear on inlet and exit rings.

- Out-of-round inlet and exit rings.

- Joint gaps and erosion.

Common issues seen and repaired for Row 2 and 3 vanes are:

- Wear on honeycomb seals.

- Corrosion on gas-path surfaces.

- Inner-to-outer wall twists.

Common issues seen and repaired for turbine vane carriers are:

- Broken bolting.

- Out of roundness.

- Hook-fit wear.

- Cracking in cooling-air passages.

Selected before and after photos show the results.

Wrap-up

Reflecting on the content of presentations and discussions during the first three days of the conference, the editors believe the following topics as being top of mind among attendees:

- Lack of experts and bench strength in many user and supplier organizations.

- Finding and getting to the right people as companies change and people retire.

- Changing operating profiles.

- Getting top management to appreciate technical and operational issues (funding, time, etc).

- Supply chains and competition for base materials; parts orders versus inventory.

- Repair-technology options and capabilities/advice.

- Awareness of technology developments at the service providers.

There was an open group discussion before the EPRI tour. Selected comments/questions from that session, often rhetorical, are summarized below:

- How do we get additional people, especially our own, more involved in what we are learning at AOG and discussing with each other? Can we increase the value of AOG at the plant level, perhaps with more online sessions? Can we make better use the Forum at AOGusers.com?

- Users need to learn more about how GE handles purchase orders for parts, and the potential advantages of a long-term service agreement. One viewpoint: GE seems to have gotten out of the parts business to some extent.

- How can we help third-party service providers keep up with technical developments being made by GE and others? It seems to be up to users to specify “the latest and greatest.” We understand that we need to be our own advocates, and that is one benefit of AOG.

- We just make sure that the Forum stays technical and does not become social, opinionated, or commercial. Some contractors already have access.

- We also need to “listen to rumors” and get the word out. The example given was one participant overhearing someone say there was a spare rotor sitting in Switzerland. Turned out to be true. There is probably other “stranded stuff” out there. How do we do this?

- We need to understand that not all divisions of GE communicate well with each other.

- Should we have other OEMs here next year for controls?

- Insurance companies seem to listen more to the OEMs. We as owners need to bring the insurers in with us for their buy-in and to share information. Insurability is very important. We should ask them, “What do you need from us?”

- People: How should we address internal staffing for the future? A few companies described their summer intern programs as having some success in identifying promising candidates. Ideas included local community colleges and Associate Degree programs.

- People: What about training materials for our employees? Can the Forum help share training? This seems to be a big common problem. And how can we better share and pass on knowledge even within our own plants?

- People: How do we talk to our HR departments and tell them what they might not know (about our needs)? Perhaps we should take them through the plants.

EPRI tour, AOG training

AOG 2023 concluded with a tour of EPRI’s many labs in Charlotte and summaries of some current projects of greatest interest to attendees. EPRI U, the onsite training and learning facility, was the final stop.

The following AOG training sessions then were conducted, concurrently, to complete the day:

- Gas Turbine Failure Analysis, Kevin Weins and Doug Nagy, Liburdi.

- Generational Diversity, Wade Younger, The Value Wave.

- P13 Blueline Training, Tom Douglas, Hughes Technical Services.

- Stator/Field Testing and Inspections, Jamie Clark, AGT Services.