The popular keynote duo of Tony Brough, president, Dora Partners & Co, and Mark Axford, Axford Turbine Consultants LLC, kicked off the 33rd annual Western Turbine Users Inc (WTUI) conference with their analysis of the gas turbine (GT) market, players, and key drivers.

Brough began with the rhetorical questions: Are GTs going away? Is the GT market viable? Answers, No, and absolutely. And Brough had the receipts, based on hundreds of conversations with investors, OEMs, and users.

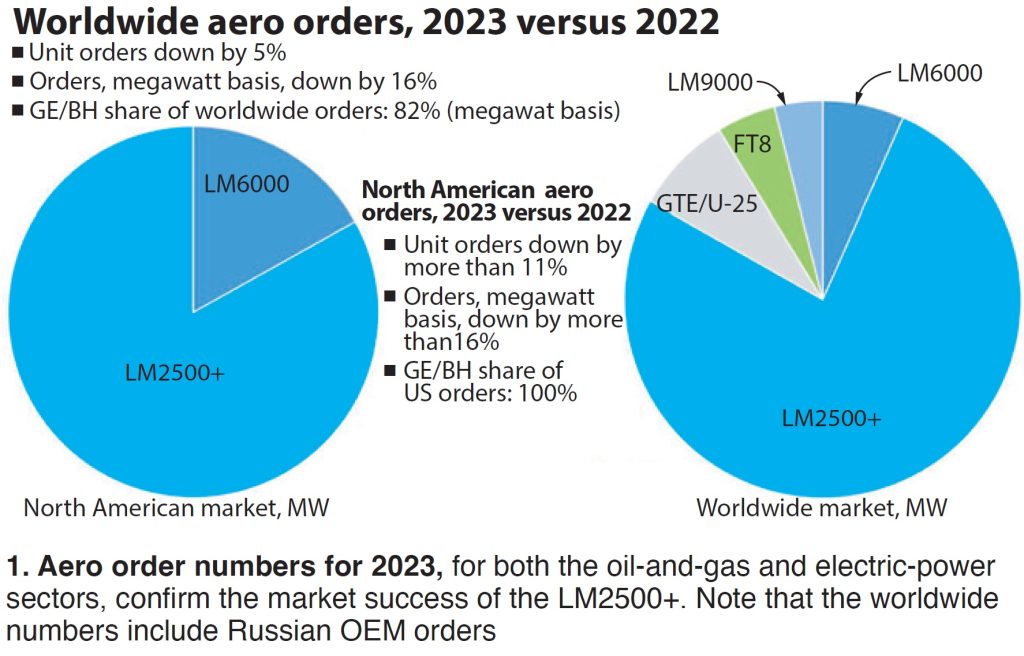

Annual global orders may have fallen 13% in 2023 in megawatts but the number of units was up slightly at 3%. Parsing out aeros from these numbers, Brough noted in his slides that North American aero orders were down 11% in units and 16% in megawatts in 2023. Worldwide, those figures are 5% and 16%, respectively.

Nevertheless, up to $137-billion is expected be spent on new packaged engines (just the engines) over the next 10 years, $22.3-billion for aero units. The forecasted aftermarket value for frames is around double that figure, and 50% higher for aeros. New machine design offerings add to owner/operator choices.

Brough explained that one reason for the inverse relationship between units and capacity is a pause in orders for the largest advanced GTs, like the latest F, G, H, and J designs, as users and OEMs work out technical issues.

The LM2500, which Brough described as a “market-killing machine,” (Fig 1) took 61% of the market between 2018 and 2023, up from its previous five-year share of 53%. For power generation, the machine took a whopping 81% of the past five-year market in the 30-40-MW capacity range. In North America, GE Vernova/Baker Hughes garnered 100% of the aero market and 82% of the global in 2023.

As for other models, the FT8 gets a small share in North America only in the 20-30-MW category, while the Siemens SGT-800 dominates against the LM6000 outside of the US in the 40-100-MW segment. Brough said only five LM6000s were ordered in 2023 (Axford later said eight), although the 2024 outlook is more positive.

Nature abhors a vacuum, but so to do market players eyeing total market dominance by one competitor. Solar Turbines is aiming its new Titan 350 design squarely on GE Vernova’s success with the LM2500. Brough gave a quick comparison of the two machines.

The Titan 350 has a slight advantage in dry-low-NOₓ emissions (9 ppm capability), and the two machines are comparable in efficiency and output. Two big differences are in weight and footprint. The Titan 350 is 50 tons heavier and almost double the footprint of the LM2500. Both these parameters rarely are important except in the oil/gas offshore platform market. Another key difference Brough notes: A user has one repair option for the Titan 350, the OEM, while there are three or four options for the LM2500.

Brough concluded by forecasting that the peaking electricity market will be a huge driver for aeros over the next 10 to 15 years.

Geopolitical instability

Axford then took the stage and mused on geopolitical events impacting the GT market. Topping the list was the war between Israel and Hamas in Gaza which, adding to the military volatility in the West Bank and general tensions in the region, could blossom into a full-fledged Middle East war. This has already caused shippers to divert cargo vessels around the tip of Africa, adding 40% to shipping costs. What happens if military activities escalate in the Persian Gulf, Axford posed.

Axford invited his audience to contemplate the impact of blowing up the Nordstream pipeline in September 2022, which used to carry Russian natural gas to Europe. Curiously, all country-level investigations into that event have been closed, according to investigative journalists’ reports.

Nordstream, claims Axford, has become a “dirty word,” and something that, geopolitically, falls under “don’t ask, don’t tell.” Yet since then, the US has displaced Russia as the chief exporter of natural gas (as LNG) to Europe. At the same time, US government regulators have “paused” permits for additional LNG export facilities, part of what Axford and plenty of others call the “war on fossil fuels.”

Axford labeled Nordstream the most important event in global energy markets since the Iraq War in the early 1990s. Even though LNG markets are currently volatile, the market for LNG is expected to rise 50% by 2026, he added.

Artificial stupidity

Joking that he’s glad no one is pushing artificial stupidity as there is enough natural stupidity to last forever, Axford then explained how the need for electricity to power AI data centers is creating huge demand for baseload power. AI data centers run 24/7/365 and the “new breed” isn’t just for storage of data but are “manufacturing sites converting data into intellectual property.”

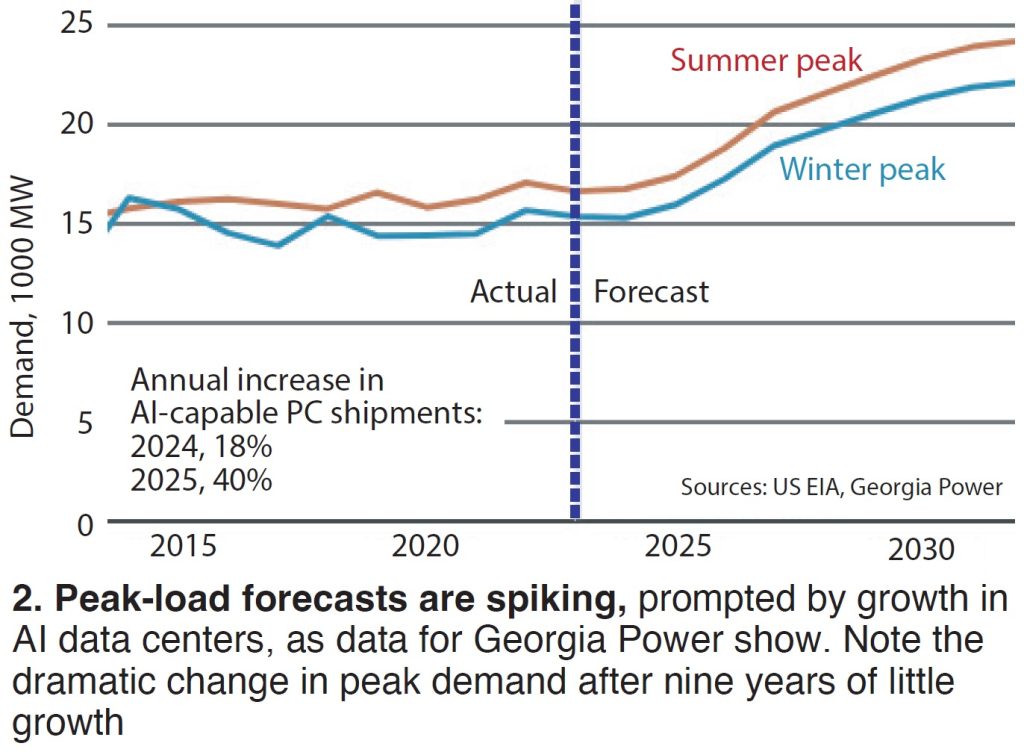

Utilities serving the AI clusters around Loudon County (Virginia), Chicago, Dallas, and Atlanta, have had to “correct” their load forecasts while economic developers are holding back new AI facilities until power supply catches up with demand. Coal-plant closures are even being delayed to accommodate the need.

“The AI demand spike on electricity is the single most important fact for you to take home,” Axford said, unless you want to be considered naturally stupid. One utility serving the Atlanta area forecasts its summer peak to rise by 40% in 2030, partly because of AI data center growth (Fig 2).

OEM circle dance

The big story with OEMs is the spinoff of Vernova from GE, Axford noted, which was completed Apr 2, 2024. This didn’t seem to affect LM2500 market activity, although the Siemens SGT-800 is “clobbering” the LM6000 overseas. MHI and Siemens are focused on their heavy frame machines; Siemens has had zero orders for aeros, MHI “hardly any sales.” Echoing Brough from earlier, “it was a great year for the LM2500.”

Axford also supported Brough’s comments on the large gas-turbine market. Siemens and MHI were numbers one and two, respectively, for large turbine orders over the last two years. While GE has captured 95% of the aero market, the OEM has “lots of work to do to win back market share” in large units.

Next, Axford offered thumbnails of others in the aero market:

- ProEnergy is selling new LM6000 gensets on a turnkey plant basis (GE Vernova sells only the engine) and is repurposing overhauled CF6-80C2 aircraft engines as the PELM6000, while also manufacturing parts for this machine.

- Wattbridge, a ProEnergy affiliate, owns and operates 50 LM6000 gensets at various plants serving the Houston area. Axford coyly notes that ProEnergy’s service shops overhaul LM2500 and LM6000 machines, “shops not authorized by GE, but by users.”

- Dynamis Power Solutions will sell you a trailer-mounted LM2500 package you can move from site to site, AMP (Accelerated Mobile Power) Solutions will lease same.

- Relevant Power Solutions also sells LM6000 and LM2500 trailer-mounted units (a/k/a TM2500).

A wild card in the market, according to Axford, is Wärtsila, not a GT supplier, by selling a 24-MW reciprocating-engine genset to customers who traditionally buy aeros and have LM6000s. Several of the recent customers for this engine, notes Axford in a slide, are competing in two-minute-start balancing markets.

The envy of the world

The diversity of US power supply is “the envy of the world,” says Axford. In order to keep it that way, Axford suggested that the industry needs to answer the question, “What is the optimal percentage of renewables?” By his account, that number is 30% to 40% if you want to balance the trifecta of reliability, sustainability, and affordability. Says a speaker who, in his opening remarks, likes to joke that “he identifies as a turbine” today, the renewables percentage is already at 26% (solar, wind, hydro).

Although the US is gunning for “net zero by 2050,” he notes that 80% of the world’s population is “not playing a role” countering global climate disruption. For example, in 2022, China approved the addition of 106,000 MW of new coal plants to its grid.

As for a fuel that many expect to play a large role in net zero, Axford asks “why do we even talk about hydrogen?” In his mind, it can’t compete with natural gas. There may be some blending of 10% to 15% H₂ in pipeline gas, and some niche plant projects, but he doesn’t think it will play a significant role in the US. Anyway, electric utilities strongly prefer battery storage paired with renewables to meet the net zero challenge. Perhaps think of hydrogen as the IGCC (integrated coal gasification combined cycle) of the power industry’s future.

EVs: Kong vs Godzilla?

Tesla is the world’s most valuable (by stock-market value) auto manufacturing company, Axford noted, as he delved into his last market-impacting trend, growth in the electric vehicle (EV) market. However, China’s BYD, selling EVs at half the price of Tesla, is closing in and could be the market share leader by the end of the year.

This is important as Tesla is selling to the dwindling “wealthy buyer,” early-adopter market, while BYD is ready to build low-cost manufacturing plants in Mexico to serve North America. Brakes on the market include the observation that “EVs are piling up on dealer lots,” and that EVs have gotten some bad press for performance during winter storms.

While China dominates in processing lithium and has a tight grip on the market for EV batteries, large lithium deposits are being found and developed in the US. “2023 was a great year for grid-scale batteries, the fastest growing segment of the market,” Axford concluded, with Texas and California leading in installations.

Form Energy’s iron-air (reversible rusting technology) long-term battery storage solution, at 100-MWh an order of magnitude larger than current offerings, has attracted orders from at least four major utilities. It is reported to be 90% lower cost than lithium-based options.

A rosy 2024

Axford ended his presentation on an upbeat note, anticipating that US gas-turbine orders will be up by 7% to 10% over 2023 (though not matching 2022’s banner year), largely driven by electricity demand in the AI sector. However, he cautioned that excessive lead times may inhibit follow-up orders.