Next meeting: Nov 12-14, 2024 • EPRI Campus • Charlotte, NC

Next meeting: Nov 12-14, 2024 • EPRI Campus • Charlotte, NC

Inquiries: ACGTUG@epri.com • Details at www.epri.com/events

Welcome the latest addition to the worldwide gas-turbine user community: The Advanced Class Gas Turbine Users Group. It was formed by EPRI to focus on issues common to the M501G, M501J, SGT6-6000G, SGT6-8000H, SGT6-9000HL, and other advanced frames (Sidebar 1), and to develop collaborative responses and solutions. The group’s inaugural conference was held Nov 2023, in Charlotte, NC.

Sharing information is the hallmark of a users’ conference, but that’s no small feat for the owner/operators of these machines. They reside at the leading edge of technology, some would say the bleeding edge. Users and OEMs are bound together by long-term service and nondisclosure agreements. It takes years before third-party service firms can access the proprietary technology and reverse-engineer solutions, and before users will trust third parties with their machines.

As one user stated, “we are completely dependent on the OEM.”

This is why a research-driven organization like EPRI, which has partnered with CCJ to launch this user group and conference, can help facilitate the necessary exchanges among the parties involved while identifying the best areas for collaborative programs.

One of the most illuminating sessions was a panel discussion among representatives from three leading insurance firms. As you’ll read later, it is obvious that the need for information sharing is great, but so too are the challenges in doing so. Catastrophic and significant failures, learning opportunities for all, are also governed by NDAs as OEMs guard their proprietary design elements.

OEMs resist even sending technical information letters (TILs) and other documents to insurers. At the same time, insurance companies compete with each other for new business, even as they cooperate to reduce, underwrite, and spread the risks.

The relationship between user and insurer can also be sensitive. For new technology, insurers demand more information from plants regarding O&M practices, the implementation of TILs, operating data, etc. When a significant loss is experienced at one plant, insurers are quick to try to avoid such a loss at other client sites. Meanwhile, plants wonder why their premiums are never reduced when they implement the insurers’ recommendations.

The symbiotic relationship among user, OEM, and insurer has always been delicate and fraught—like trying to dance with two partners and never quite receiving all the signals and gestures needed to know where and how to move next. It’s just that everything is heightened when the technology is new and proceeding through its paces.

1. EPRI facilitates the implementation of advanced gas-turbine technologies

The Advanced Class Gas Turbine Users Group focuses primarily on G-, H-, and J-class engines with firing temperatures above 2600F. However, advanced technologies found in 7F.05 units, as an example, are also included because of their similarities in uniqueness. From materials and coatings to combustion systems and challenging operational profiles, these advanced units are ever pushing their operational limits and are a primary focus of ACGTUG discussions and experience-sharing.

EPRI’s Gas Turbine Advanced Components and Technologies program (a/k/a Program 217) supports owner/operators of gas-turbine assets, especially those served by the ACGTUG. Research in the following areas assists users in procurement, operation, and maintenance:

- Combustor innovations and use of alternative fuels.

- Compressor durability and innovation.

- GT enhanced controls and monitoring technologies.

- Hot-section advances in alloys, coatings, and cooling.

- New gas turbines and experiences.

- QA: Component inspection and testing technologies.

Program 217 R&D projects for 2024 seek to broaden and strengthen research focused on new and next-generation components and technologies for gas turbine. In some cases, work is coordinated with Program 216, “Gas Turbine Lifecycle Management,” and related generation programs sponsored by the research organization—including heat-recovery steam generators, materials, nondestructive evaluation, monitoring and instrumentation, controls, and flexibility. For more information, contact Bobby Noble (bnoble@epri.com), senior program manager for gas-turbine R&D.

REGISTER TODAY attend ACGTUG 2024 on the EPRI campus in Charlotte, NC, Nov 12-14. Details are available at www.epri.com/events.

Setting the stage

Neva Esposito, EPRI VP Energy Supply and Low Carbon Resources, kicked off the conference by offering a glimpse of the industry to 2050 (Fig 1). One of the more interesting forecasts was that electricity is anticipated to be between 43% and 59% of final energy in 2050. That figure was 20% in 2020. For perspective, it took the industry well over a century to achieve 20% final energy; now the percentage is expected to double in 25 years as electric vehicles (EV) displace fuel-powered vehicles, data centers suck up more and more electricity, and general electrification of society accelerates.

GT owner/operators don’t need to be reminded how renewable resources are affecting their operations. So, it was almost astonishing to learn that in 2022, solar represented only 3% of electric production, and wind 10%. It’s a case of the tail wagging the dog, but the tail is only expected to get fatter and bushier.

Several representatives of utility and non-utility power producers presented on their O&M experiences with advanced gas turbines on the second day of the meeting (Fig 2). The information shared with attendees was viewed as of considerable value to owner/operators, based on comments shared by attendees with the editors. Unfortunately, on-going investigations and pending litigation militated against CCJ’s coverage of this material both here and online.

Suggestion: Attend ACGTUG 2024 EPRI’s facilities in Charlotte, NC, Nov 12-14, 2024, and take detailed notes to share with your management and colleagues. What you learn almost surely will be a positive impact on the operation and maintenance of your existing assets while providing guidance in the design of future generating units.

‘We are the checkbook!’

The frustration in the room was palpable during the panel discussion with insurance-firm representatives, even as everyone maintained an outward spirit of learning and improving.

One insurance firm rep summed it all up as “You are the test stand, we are the checkbook!” It might be surprising to learn that insurers only hope to break even on insurance; all their money is made on investments.

More specifically illuminating for plant folks is how an insurance firm distinguishes proven from unproven technology. Thus, it was eye-opening to learn that one firm still considers the 7F.05 unproven. Why, asked a member of the audience, for an 11-year-old machine? The response from the rep was that they took it off the unproven list but then compressor problems persisted, components were redesigned, and so it was returned to unproven.

The rule one insurer uses is this: Proven means that the first two fleet leaders for the new technology both got through a major outage with no major issues and no component redesigns. If a critical component is redesigned, then the “clock” goes back to zero. Insurers also factor in whether they consider the OEM’s response to fleet issues to be a “patch” or a long-term “solution.”

Eight years later, the HA series is still considered by some insurers to be unproven. According to one, although the OEM did “pretty well” managing the Gen I bucket issue, there are other persistent issues like the 0 spacer issue, the thrust bearing, and changes in the clutch design. “The ground is shaking around some of these HA units,” one panelist said. That perhaps is one reason why one user’s HA unit is considered unproven even with 32,000 operating hours.

Resolving issues with the technology is only one aspect of today’s insurance challenges. Two of the others are the supply chain and inadequate quality of shop and repair work. An example of the latter is a first-stage blade failure resulting from the shop putting four times the amount of thermal barrier coating (TBC) on the blades. “Third party shops are hard to qualify,” concluded one panelist.

Another issue mentioned is more fundamental. Design engineers are specialists in a specific turbine component, lamented one insurer rep. “There’s no longer ‘one master machine engineer’ like in the old days.” When asked how they view insurability across the OEMs, one said burning holes through blades and nozzles is similar even if the causes are different.

TILs (Technical Information Letters) were the subject of robust discussion, too. One panelist questioned whether TILs actually address root causes or treat symptoms. Another asked, “What are the unintended consequences behind the TIL recommendation?” Insurers are also monitoring not only that TILs are implemented in a timely way but that the TIL was implemented in the best way possible for the particular site.

You couldn’t be blamed if you came away from this session thinking that the owner/operator is between a rock and a hard place. Insurers conceded that many critical aspects of insurability are out of the user’s control. When all of the fleet’s blades are made in one factory worldwide, or all the clutches have to be sent to one location in England for repair, or the number of qualified forging shops is limited, these are all supply-chain bottlenecks. Parts scarcity is a huge issue for insurers.

One attendee muttered that it’s like we need to have a duplicate machine onsite just for spares. But even that strategy, expensive as it may be, may not be sound. One panelist noted that spare components become obsolete because six months later the design changes.

As much as users and insurers might want to share information, advanced frames are so proprietary “we can’t even get a mass communication out to our clients,” said one insurer rep. Units which are the subject of litigation between the OEM and user can’t be talked about. Even the evaluation of a catastrophic loss event is governed by tight nondisclosures.

The sharing of information, such as TILs or technical bulletins, depends on the transparency of each OEM. While one panelist said that “some were better than others,” another said, “all OEMs are bad about sharing.” A third went further, saying they can’t get one OEM to respond to requests for these critical docs. The suggestion was that the OEMs are more interested in hiding problems from the insurers. One audience member intimated hat they were afraid that underwriters will add an exclusion for a TIL component.

Insurance is, by its nature, collectively punitive. One panelist explained that what moves the needle on premiums is a catastrophic-loss event. The “Law of Large Numbers” dictates that the more bad actors there are in the fleet, the more everyone pays in premiums. Such a loss event also motivates everyone to get focused, not only on that particular risk but on machine risks generally.

Business interruption (BI) also drives premiums and the panelists encouraged the users to do what they can to minimize BI lost hours—such as emergency spare rotors, access to HGP components, etc.

That ‘90s show

If all of this sounds familiar to seasoned industry veterans, that’s because the industry went through a similar protracted “learning curve” with the original F-class GT technology. The first demonstration F machine was operating in the early 1990s. By the late 1990s, the OEM was airlifting machines from around the world to its shops for repair of critical components. Insurers were experiencing huge losses. In fact, a conference was convened which brought together insurance companies, users, and OEMs to grapple with the emerging issues.

CCJ reported out the early operating experience with the HA machines from the first and second HA User Group meetings in 2018 and 2019. If you join up that material with what’s being reported here, you’ll see how the trajectory from unproven to proven overlays with the experiences from the 1990s.

Rotor risk assessment

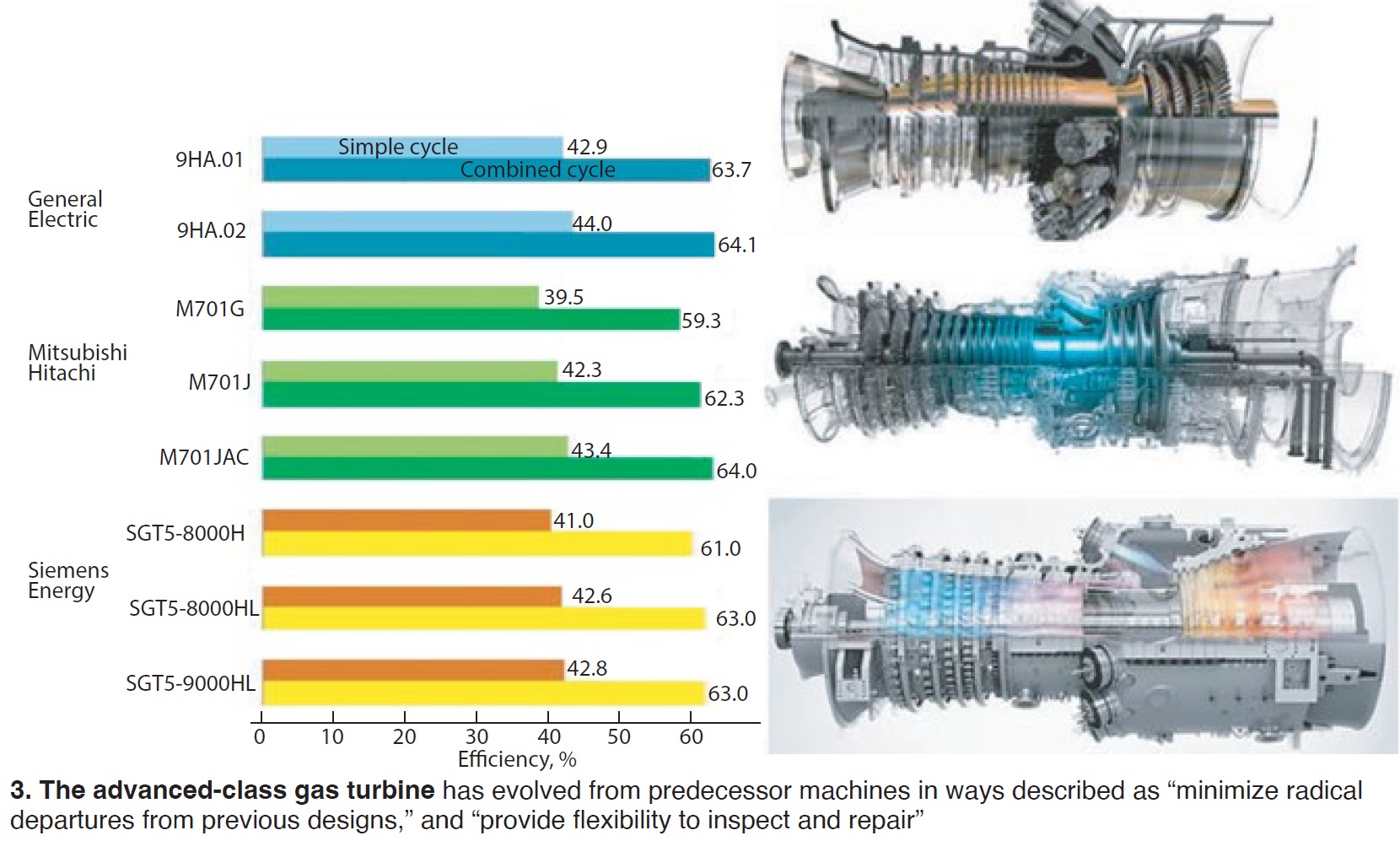

John Scheibel, EPRI technical executive, drilled down to risk assessments for the advanced-class rotors. He started by offering a generic description of the G, H, and J machines in terms of air flows, output, efficiency (Fig 3), turbine inlet temperature, cycle pressure ratios, and other parameters, then how the machines differ in four areas: construction, materials, assembly/disassembly, and turbine stages for power generation.

Request a copy of this presentation from EPRI if you are looking for a succinct review of the three major OEM designs, design philosophies, and willingness to push towards technology limits in the design. EPRI’s work in this area includes identifying high-risk components, assessing the probabilities for users to reach the rotor life limits specified by the OEM, and rotor material testing. A brief explanation of EPRI’s probabilistic risk assessment and FMEA ranking methodologies are also included in Scheibel’s slides.

Earlier EPRI work, dating as early as 2000, identified 30 potential durability issues with the F-class machines, including a handful not associated with TILs. Surprisingly, many of the high-risk issues involve design corrections, harkening back to the earlier comments by the insurers on the unintended consequences of implementing TILs.

The relevant conclusion here is that independent assessment of rotor durability will assist users in making decisions which may differ from OEM recommendations or predictions. Durability testing has already ensued of Inconel 706 (a/k/a IN706), the HA rotor material, and other HA hot-section components.

Round-robin issues

Day Two of the conference involved more intimate conversations among users. Below are some of the gems most applicable to the user community, based on notes taken by the organizers:

- Some users consider sensors, such as haz gas, nuisance alarms since they can trip the unit, but they are often required by insurers.

- One user mentioned that all of their advanced-class turbines use HEPA filters for inlet air filtration.

- Some HA users have experienced blockage of turbine-blade cooling holes because of debris originating in the compressor casing. The OEM offers a coating solution that does not require removing the rotor. Others have experimented with filters.

- Users with a coated compressor discharge casing are seeing oxidation in the rotating section—after Stage 6 in one case. One noted that, for their simple-cycle GT, they are coating anything that can be coated for oxidation resistance.

- The 501G may be on its seventh redesign to prevent rotor through-bolt fracturing, according to one user.

- The HA last-stage (14th) compressor blades are shifting such that there are gaps between the blade and the base.

- The combustion liner in the first SGT6-9000HL in the UK burned through, and the OEM is still in RCA.

Users opine on other issues

Several user presentations covered tangential subjects of general importance to the community, including the following:

Outage oversight. These post-outage findings might be familiar to readers: bolts not properly torqued, alignment changed after the last data sheet was submitted, transition-piece seals not installed correctly, flush plug left in, and thermocouple wires pinched. They occur because procedures and tooling for advanced-class-machine outage work are not fully developed and craft workers are inexperienced, said the presenter, representing a large fleet owner/operator.

However, also at fault may be inadequate supervision and oversight by the owner/operator and lack of a quality-control plan. The QCP should be agreed to in advance with the contractors, and include trained, experienced quality observers who identify witness points, hold points, and measurement techniques and data which will be reviewed by the affected parties. A QCP should also be developed for major shop work.

New tools in development by EPRI and its partners can help in identifying manufacturing defects and poor metallurgy that might be missed by QA/QC teams (Sidebar 2).

Aging workforce. Ask yourself, do you have one document that carefully charts the history of each unit in your plant? It should include commercial operating dates, implementation dates for each TIL, experience and details with the first and subsequent machine wrecks, fuel-nozzle upgrades, flashback incidents and liner replacements, exhaust-section replacements, and so on.

You should also have a policy for retaining and storing all email strings on specific machine O&M issues and resolutions as they arise. All of this is part of “tribal knowledge” which must be transferred as efficiently as possible to newly appointed responsible entities. Other forms of tribal knowledge include O&M procedures, operator aids, training videos, etc.

As the presenter stated up front, recapturing tribal knowledge lost when a seasoned veteran retires or quits is very costly. Searching for information and trying to retrieve it is wasted time. Storage devices and retrieval need to keep with available technology. Many engineers and technicians are loathe to write detailed reports, but capturing such knowledge must become part of the plant’s culture—like safety, cybersecurity, and other objectives.

Lifecycle management. First, a plan or strategy should be in place from Day One of the machine’s operating life. Sourcing today is a different ballgame. You may need to accept some risks, like buying and reserving slots at a shop or the manufacturing facility without a specific project in mind. This plan should reflect changes in the machine’s operating profile over time and experience with earlier turbines in your fleet. Perhaps most important for dealing with your financial team: Consider ways to calculate the probability of failure versus the lead time required to obtain the components.

2. Use PCRT to qualify metallurgy, identify manufacturing defects in turbine blades

During manufacturing and repair processes, industrial-gas-turbine (IGT) hot-section blades are subjected to a range of destructive and nondestructive (NDT) testing methods to assure structural integrity and uniform quality. Microstructure is an important characteristic of a component because it dictates overall strength and directly influences usable life via probability of defect initiation and propagation.

Thus, much effort is put into obtaining the optimal microstructure of turbine blades. Generally, one component from a given set is sacrificed to run a metallurgical analysis and determine the microstructural state of the remaining parts. This process is expensive, time consuming, and cannot capture the full-population variation. Nondestructive methods can provide full component-set inspection as opposed to the destructive sampling methods generally employed.

Several NDT methods are capable of some amount of metallurgical characterization—including x-ray diffraction and ultrasonic testing—but they are limited to surface or point-by-point inspections. Resonance inspection is an alternative method that has gained traction during the last two decades, particularly in the aerospace industry.

Resonance methods, such as Process Compensated Resonance Testing (PCRT) are full-body ultrasonic methods that rely on the modal response of a component and hence mechanically interact with the microstructure. The mode shapes and frequencies collected from a component serve as a resonance fingerprint and are dependent on the material, microstructure, geometry, and presence of defects.

PCRT uses a stepped-frequency sine-wave excitation to drive a part to resonate and then records the resonance spectrum. It applies advanced statistical analyses and machine learning to the resonance spectrum to assess components and identify parts with defective conditions, including defective metallurgy.

The capabilities of PCRT have been demonstrated in the lab, by modeling, and through operational inspection applications. PCRT has more than 10 years of proven success in the aerospace industry and is the only NDE method to be granted approval by the FAA to replace metallurgical cut-ups for the disposition of blades that have experienced-over temperature exposure.

The experience accumulated in aerospace PCRT applications is being leveraged for inspection of power-turbine components by Vibrant Corp, Albuquerque, NM, in partnership with EPRI.

Although PCRT analysis of IGT blades is in the nascent stage, it has already proven useful to multiple gas-turbine owner/operators by providing a quick and easy receiving inspection for evaluating a component’s fitness for repair, and for assessing the consistency of material rejuvenation heat treatments.

Work to further quantify PCRT response to specific IGT blade defects and related quality standard characteristics is ongoing. Collaborative efforts in building an EPRI database for various IGT models has expedited the ability to use anonymized data for statistical analysis and population characterization. More than 20,000 components already have been scanned and incorporated into the database.

For more information on this valuable resource, contact Nick Smith (nsmith@epri.com), senior technical leader for EPRI Program 216, “Gas Turbine Lifecycle Management,” and Program 217, “Gas Turbine Advanced Components and Technologies.

Thoughts from 3rd-Party Consultants

Several consultants and suppliers were invited to share their expertise on the first day of the meeting. Here’s what four had to say:

Environex on causes of SCR non-performance. Environex’s Andy Toback, a staple at user-group meetings, always is good at reminding users that the SCR is a chemical process and catalyst-driven chemical processes typically are optimized around temperature, pressure, catalyst surface characteristics, and concentration of reactants and their desired/undesired byproducts.

One important point: The CO catalyst design is driven by the types of higher-order hydrocarbons (propane, butane, hexane, formaldehyde) in the exhaust and their concentrations in the flow stream. In other words, other reactions are going on besides CO to CO₂. These other reactions complicate the process and the conversion of NO to NO₂.

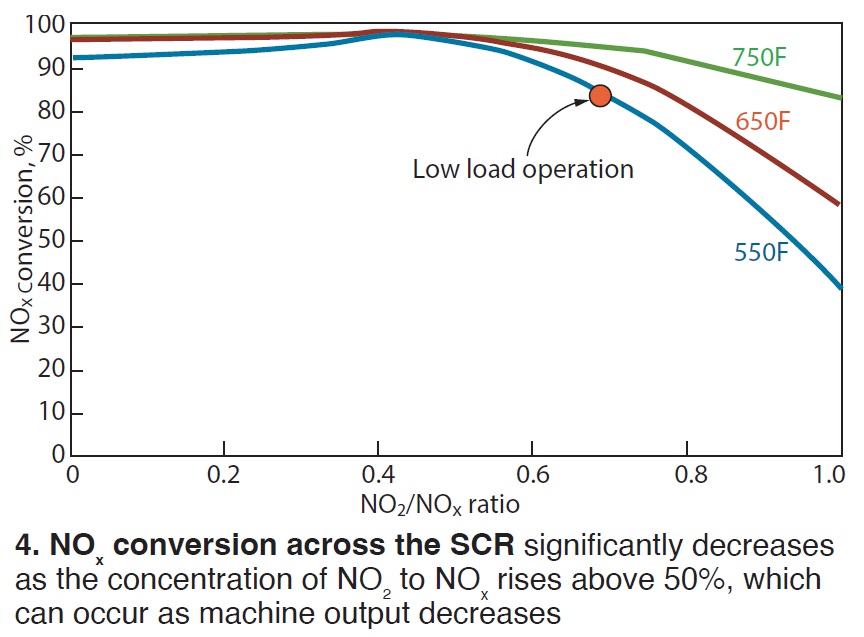

Toback reported on a case study of elevated NO₂ concentrations at an advanced GT plant (Fig 4). The plant was experiencing double the design ammonia flows at low loads, and temperature problems with the ammonia vaporizer at high flows. All of the catalyst samples tested showed excellent results so it wasn’t a question of catalyst quality.

Here’s a cause of non-performance which may not be as familiar as others: Exposed insulation upstream of the SCR affects performance because loose catalyst particles mask catalyst surfaces and plug ammonia injection grid (AIG) lances and ports.

Another common problem is that lower load operation, and lower temperature across the CO catalyst, induce more oxidation of NO into NO₂. Higher NO₂ levels, in turn, require more “work” from the downstream NOₓ catalyst. However, if you add catalyst to compensate for the higher NO₂, you increase the pressure drop. Catalyst performance drops when NO₂/NOₓ is greater than 50%.

In the case study, the additional catalyst needed to compensate for high NO₂ increased pressure drop by 0.6 in. H₂O. On the bright side, SCR performance improved considerably after the catalyst surfaces and the AIG nozzles were cleaned.

SI on rotor design evolution. Matthew Ferslew of Structural Integrity Associates (SI), covered the evolution of rotor design and the challenges imposed. Rotors have become lighter and lighter, even as megawatt output, efficiency, and the need for greater operating flexibility (that is, more starts and stops) have increased.

Lighter alloy steels have to operate at higher and higher temperatures which impose new creep, thermal-gradient, and fatigue regimes. Ferslew used the term “chaos of design” to describe how design objectives often conflict.

He emphasized the importance of lifecycle management, especially accurate condition monitoring and predictive analysis, to extend the life of these assets and prevent failures. He also suggested the intriguing concept that, in a high-starts world, perhaps the industry needs a rotor expressly designed to start three times daily and/or an effective thermal-gradient management methodology when 10-minute starts are required.

Advanced Turbine Support on M501G observations. Advanced Turbine Support LLC trained its prodigious inspection capabilities on the M501G, GAC, and GAC enhanced- response machines. The photo-rich slides illustrate compressor icing damage, combustor coating loss and cracking, TP seal erosion, turbine-vane platform erosion, and turbine-section coating loss and base-metal cracking (Figs 5 and 6).

Regarding the last item, one user commented that they have also seen this level of cracking and as a result did not make their scheduled outage interval. The parts have to be replaced with newer versions but they aren’t sure the OEM has determined the root cause or long-term solution. Clogging of cooling holes causes the problem. OEM is experimenting with filters to remove the debris.

Gas Turbine Specialists on outage oversight. The cost of quality (or lack thereof) in the utility sector was said to be 15% of revenue. Foreign material left in the turbine after an outage can cost up to $100-million when implicated in a catastrophic loss. With these and other alarming stats, Joe Mitchell of Gulf Turbine Specialists, stressed the importance of, and role for, an independent owners/engineer (O/E) during outages (Fig 7).

He showed a photo of a water bottle left in the generator discovered after the OEM field inspection had taken place. In another case, the O/E identified a dislodged end-turn block in the generator after the generator specialist was released from the site and the OEM field inspection team had completed its rounds.

Mitchell also reviewed some major projects his firm was responsible for—including a 7F.02 to 7F.03 flange-to-flange upgrade, 7FA.05 flange to flange upgrade, diverter-damper overhaul, and project management for a steam-turbine overhaul.