ProEnergy’s growing presence on the aeroderivative gas turbine stage is undeniable, owning and operating 2.4GW of peaking capacity, along with complete overhaul services for LM6000 and LM2500 engines, and turnkey powerplant development.

ProEnergy’s growing presence on the aeroderivative gas turbine stage is undeniable, owning and operating 2.4GW of peaking capacity, along with complete overhaul services for LM6000 and LM2500 engines, and turnkey powerplant development.

Customers and industry leaders from around the globe filled the seats at its third annual conference, PEC2024, in November. The exciting future for the company only gets more interesting with the announcement of its new majority stakeholder, Energy Capital Partners, positive field results of the first PE6000 gas turbines, and explosive electricity demand growth, to name a few.

The conference has its roots in training owner/operators, featuring a shortened version of the four-day, on-site, intensive training programs offered for the LM6000 and LM2500. One full day of familiarization guided by ProEnergy SMEs, generator partner BRUSH, and emissions control partners EnergyLink International and Environex provided a great opportunity to learn and share best practices for LM technology.

Beyond the opportunity for technical training, PEC provides a compelling look at the future of the global energy industry, highlighting the critical need for adaptation and innovation in response to evolving market demands. As you read this report, it’s clear to see the immense challenges and opportunities facing the generation sector as it navigates rising electricity demand, grid modernization, and the transition to cleaner energy. Insights on balancing innovation with reliability, the growing role of gas turbines, and the impact of data-driven strategies in power generation from varying perspectives are on display and strike a common chord.

Embracing disruption

The general session kicked off, as is custom, with resident raconteur, Carlos Picon, as thought-provoking and dazzling as ever addressing the rapidly evolving energy landscape and the challenges and opportunities that lie ahead. His message was clear: the world is facing an unprecedented demand for power, and the industry must adapt to ensure a reliable, efficient, and sustainable future.

Picon began by highlighting the rising global demand for electricity, particularly in 2024 and 2025, driven by factors such as economic development, heatwaves, and industrial expansion across regions like Asia and Africa. Although renewable energy sources—such as solar, wind, and hydropower—now supply 30% of the world’s electricity, they still face significant scalability and reliability challenges.

Hydropower, for instance, has suffered from declining output, with a 5% drop this year and a 20% drop the year before. Meanwhile, while renewable energy is making progress, thermal power remains essential for maintaining grid stability, ensuring that businesses and households receive uninterrupted electricity. The transition to cleaner energy is happening, but it requires careful planning and infrastructure improvements to prevent disruptions.

One of the most pressing challenges is the growing energy demand from data centers. By 2026, their power consumption is expected to match that of entire nations, creating strain on existing infrastructure. Some of the world’s largest technology companies have even had to lower their growth projections for 2025 and 2026, not because of financial constraints, but because they lack the power needed to support new data centers.

Beyond data centers, if you can imagine anything beyond data centers, the power transmission infrastructure itself is lagging, particularly in high-demand areas. Picon pointed to California’s rising wholesale electricity prices, warning that inflexible power grids and regulatory inefficiencies will continue to burden consumers unless urgent action is taken.

Picon drew historical parallels to illustrate the importance of disruption and bold leadership. He referenced the Wright brothers, who faced immense technical and societal challenges but ultimately revolutionized aviation. Similarly, the energy industry must embrace innovation to ensure long-term progress.

More recently, Kodak’s failure to adapt to the digital camera revolution proved costly and led to the company’s decline. In contrast, SpaceX’s ability to disrupt the aerospace industry through reusable rockets serves as an example of how companies can embrace change and thrive. Picon warned that energy companies that resist innovation risk being left behind, much like legacy businesses that failed to adapt to market disruptions.

ProEnergy, he emphasized, has undergone a remarkable transformation—evolving from a small service provider to a key player in independent energy solutions. The company continues to expand its global operations, with new facilities opening in Arizona, Argentina, and Europe. These expansions are part of a broader effort to enhance grid reliability, efficiency, and affordability.

Picon urged attendees to challenge their assumptions, engage in open discussions, and embrace collaboration. He stressed the power of storytelling and shared knowledge, reminding the audience that progress happens when people listen, learn, and innovate together.

What say EPRI?

Reinforcing Picon’s outlook was Bobby Noble, the ERPI gas turbine R&D program director, who spoke on the evolving energy landscape, emphasizing the need for a balanced approach between clean energy transitions, reliability, and surging global power demand.

Noble drew on his vast experience with global power generators, all dealing with their own sets of challenges. The rapid increase in electricity demand, driven by urbanization, industrial growth, and the expansion of energy-intensive digital infrastructure like data centers. While clean energy solutions continue to gain traction, he warned that the grid cannot solely rely on intermittent renewables without adequate dispatchable power—resources capable of producing electricity on demand. Without these, the risk of blackouts and system failures grows.

Despite the push for decarbonization, gas turbines remain indispensable for maintaining grid stability, particularly in high-demand scenarios. He pointed to their efficiency, scalability, and role in hybrid models integrating hydrogen and low-carbon fuels. While battery storage has a role, it cannot yet replace dispatchable power sources in managing long-term fluctuations.

Noble cautioned against aggressive retirements of fossil fuel plants without viable replacements, warning of potential energy shortages. While global policies are accelerating the shift to clean energy, permitting delays and regulatory complexities are slowing new power developments. He stressed the need for pragmatic regulations that balance decarbonization with grid reliability.

A key concern in is the projected exponential rise in electricity consumption from data centers, with forecasts predicting a 4-5x increase in demand over the next decade. Major tech companies are already adjusting expansion plans due to energy constraints, underscoring the urgency of securing reliable power sources.

Noble concluded by urging industry leaders to invest in clean energy research, strengthen international collaboration, advocate for balanced regulations, and prepare for rising energy demands. He emphasized that energy transition decisions made today will shape the reliability and sustainability of future power grids.

Here comes the sun (and gas)

Chris Jimenez delivered an insightful glimpse into the challenges faced by members served by Arizona G&T Cooperatives (AZG&T), where he functions as executive director. He detailed the cooperatives’ efforts to modernize infrastructure, integrate renewable energy, and build trust with its members in the face of evolving energy demands and market challenges.

AZG&T plays a vital role in supplying electricity to both rural and urban areas, adapting to shifting energy needs with a growing focus on sustainability. Investments in infrastructure have expanded access to reliable power, ensuring that remote communities are not left behind in the transition to cleaner energy. However, regulatory hurdles, market fluctuations, and rising energy demand—driven by urban expansion and agriculture—require strategic planning and investment.

While renewables like solar and wind are gaining traction, natural gas remains an essential stabilizing force in Arizona’s energy mix. Jimenez emphasized its role as a bridge technology, providing backup power when renewable sources fluctuate. Community support for hybrid energy systems, combining natural gas and solar, has driven AZG&T to invest in 258-MW of LM6000-powered generation that will maintain grid stability during peak demand.

Recognizing the challenges of intermittent renewables, the cooperative has expanded investments in solar and wind while prioritizing energy storage solutions. A recent $55 million government grant is helping fund new battery storage projects to enhance grid efficiency and reliability.

Community engagement remains central to AZG&T’s strategy by fostering transparency through surveys, town halls, and education initiatives. Informing members about energy costs, infrastructure investments, and sustainability efforts, the cooperative strengthens trust and support for its initiatives. By maintaining investment in both natural gas and renewables, AZG&T aims to create a resilient energy future capable of meeting the Grand Canyon State’s growing power needs.

Back to the future

Mark Axford, a very well-seasoned expert with 58 years’ experience in the gas turbine industry and full of new material, delivered a presentation on the state of gas turbines, the increasing demand for electricity, and the evolving landscape of energy policy and technology, beginning his presentation with the proclamation, “I love gas turbines.”

He reflected on the evolution of these beloved machines, noting that what was once considered a large turbine, such as the GE Model 7B, has now been eclipsed by much more powerful and efficient models. The demand for electricity, particularly from data centers and AI computing, has surged beyond expectations. In early 2023, regulators significantly underestimated electricity consumption, leading to power shortages in key markets. Texas, in particular, is experiencing rapid growth, with an additional 40,000 megawatts of power needed over the next five years—an annual increase of 8%, a rate not seen since the 1980s energy boom.

To meet this growing demand, some coal plants that were previously slated for closure have been brought back online. At the same time, orders for gas turbines have risen sharply, with a 25% increase in 2024 compared to the previous year. However, long lead times for new turbines—ranging from 12 to 18 months—have created additional supply constraints. As a result, developers of new data centers are now being told to “bring your own electricity,” signaling a shift in responsibility for securing power generation.

The industry is also undergoing structural changes. General Electric has split into three separate entities: GE Vernova, which focuses on energy and power, GE Aerospace, which specializes in aviation technology, and GE HealthCare. Meanwhile, companies like Siemens Energy and Mitsubishi Power are expanding their turbine production to keep up with demand. However, rising turbine costs and extended production timelines may deter some potential buyers.

Regulatory and policy shifts further complicate the energy landscape. The legal principle of Chevron Deference, which has granted federal agencies regulatory authority for the past 40 years, is under reconsideration. If overturned, it could significantly impact environmental and energy regulations.

Additionally, potential changes in U.S. energy policy—particularly when Trump-era policies are reinstated—could favor domestic gas production and fossil fuels over renewable incentives. At the same time, nuclear power is regaining traction, with Georgia Power recently bringing the first new nuclear plant online in 40 years. Microsoft has also announced plans to repurpose a retired nuclear reactor to power its data centers.

Despite the growth of renewable energy sources, gas turbines remain essential for maintaining grid stability. Battery storage, particularly in California and Texas, is expanding rapidly, with projections estimating a capacity of 20 gigawatts by 2026. However, battery storage alone cannot fully replace gas turbines, as reliable, dispatchable power is still required to balance intermittent renewable energy output. Axford concluded by emphasizing that dispatchable power sources, such as gas turbines, are not just part of the energy transition—they [IT] are [RM] the energy transition.

Data-driven analysis

Strategic Power Systems (SPS) has been gathering LM engine data for nearly 40 years giving Tom Christensen plenty of ammunition to provide a comprehensive look into the evolving challenges and opportunities in the power generation industry. He emphasized the growing importance of data-driven decision-making in maintaining reliability, efficiency, and long-term sustainability in power production.

SPS has been instrumental in collecting and analyzing operational data from power plants across the U.S. and internationally. This vast database allows the company to track performance trends, identify maintenance needs, and provide actionable insights to plant operators. By leveraging analytics, SPS helps utilities optimize operations, extend asset lifespans, and reduce costly downtime.

One of the key themes of Christensen’s talk was the increasing demands placed on existing power infrastructure. Over the past decade, power plants have been required to operate for longer hours due to rising electricity demand, delays in new power plant construction, and market fluctuations that encourage the maximization of existing assets. In many cases, annual operating hours per plant have increased by 20-50%, pushing many facilities beyond their original design limits.

This heightened utilization has also accelerated wear and tear on critical components, leading to an increase in forced outages and unplanned maintenance. Christensen identified several factors contributing to these disruptions, including aging infrastructure, regulatory uncertainty, supply chain issues, and extreme weather events. He particularly highlighted the growing frequency of transformer failures, turbine malfunctions, and control system breakdowns, which can take months to repair if replacement parts are not readily available.

One of the most pressing concerns he raised was the rising cost and duration of forced outages. Traditionally, maintenance schedules were carefully planned to minimize downtime, but recent industry shifts have made it increasingly difficult to adhere to these schedules. As a result, many power plants are experiencing prolonged outages lasting from several days to months, significantly impacting grid reliability and operational costs.

Despite these challenges, Christensen pointed to predictive analytics and data transparency as key solutions for improving power plant performance. SPS’s data-driven approach enables operators to anticipate failures before they occur, allowing for proactive maintenance that can prevent costly breakdowns. By analyzing historical trends, power plants can better plan for necessary repairs, reduce unexpected downtime, and allocate resources more effectively.

Looking ahead, the power industry faces a series of critical challenges, including the transition to renewable energy, regulatory changes, and workforce retention. Additionally, the industry must contend with a shrinking workforce of experienced operators and engineers, making data retention, training, and knowledge transfer more critical than ever.

Industry issues panels

No PEC is complete without engaging panel sessions with participants representing a wide swath of stakeholders and expertise the world over. Overarching topics included:

- Shifting dynamics in power generation and government regulation

- Mitigating risk and maintaining reliable plant operations with fewer resources

- Insurance essentials for LM users

Bright future, proceed with caution

Industry leaders, policymakers, and experts explored the complexities of the energy transition, addressing grid reliability, regulatory hurdles, affordability, and the evolving role of dispatchable power.

The discussion began with the growing politicization of energy policy, where public perception often diverges from industry realities. Panelists emphasized the need for rational, informed discussions rather than ideological debates. Public education remains crucial, as social and corporate pressures for renewable energy often clash with grid stability needs.

Dispatchable power sources such as gas, hydro, and nuclear remain essential for grid reliability, particularly as extreme weather events highlight the risks of over-reliance on renewables. The Texas grid failures underscored this challenge, and while battery storage is advancing, it alone cannot meet the demands of a renewable-heavy grid. Many panelists maintained that natural gas will remain critical for energy security, even amid decarbonization efforts.

Rising electricity demand, driven by data centers, AI, and electrification, is straining energy markets. Panelists expressed concerns over whether current policies and investments can sustain this growth, particularly with permitting and regulatory bottlenecks delaying much-needed power projects. The slow pace of regulatory adaptation, along with carbon taxes and emissions limits, further complicates long-term energy planning.

Affordability was another major concern, with some panelists warning of a potential two-tier energy system where wealthier regions access cleaner, costlier power while others struggle with rising prices. Government subsidies and policy-driven market distortions were debated, with some advocating for more competitive, market-driven pricing structures.

Investment uncertainty also looms large, as inconsistent policy signals deter long-term commitments. The energy industry is increasingly diversifying, exploring hydrogen, carbon capture, and next-generation nuclear, but private investors remain cautious due to regulatory and market volatility.

Looking ahead, the panelists stressed the importance of a pragmatic, flexible energy transition. Hybrid models integrating renewables with traditional power sources appear to be the most viable path forward. While nuclear energy is gaining renewed interest, permitting and cost challenges remain. Carbon capture and hydrogen technologies are still in early development but hold promise for decarbonization.

The panel reinforced that energy policy must balance decarbonization with reliability, affordability, and economic feasibility. While regulatory and market challenges persist, technological advancements and adaptive strategies offer pathways to a more sustainable, resilient energy future. Industry collaboration will be key to ensuring energy remains secure, accessible, and cost-effective.

Doing more with less

A panel of end users shed light on the operational challenges facing the gas turbine industry, particularly as electricity demand rises, grid conditions evolve, and regulatory pressures mount. One major concern was the aging fleet of gas turbines, which requires extensive maintenance and modernization to remain viable.

Extreme weather events and recent grid disruptions have emphasized the need for fast-response dispatchable power, with gas turbines continuing to serve as a critical backup for intermittent renewable sources like wind and solar. However, extended runtime requirements and increased cycling have led to higher maintenance demands and unexpected failures, further straining operations. Additionally, global supply chain bottlenecks have made it difficult to access critical replacement parts and technical expertise, delaying necessary turbine maintenance.

The discussion also explored how the rapid integration of renewables has reshaped the role of gas turbines. With the increasing penetration of wind and solar power, gas turbine operators are experiencing reduced run hours and declining revenues, making it difficult to justify reinvestments in existing fleets.

Another critical issue addressed was the changing workforce in the gas turbine sector. Many senior operators and engineers have retired, leading to concerns about the loss of institutional knowledge within the industry. In response, companies are implementing mentoring programs and knowledge transfer initiatives to train the next generation of turbine operators.

However, attracting new talent remains a challenge, as fewer young professionals are entering the field. The panelists emphasized the need for greater outreach to engineering students and young professionals, highlighting the essential role of dispatchable energy in maintaining a stable power grid.

Powering protection

The participation in information exchange by insurance companies at user groups and industry events has increased dramatically in the past few years and has been viewed positively by attendees and the editors of CCJ. Here, panelists from the world’s largest providers explored risk management, underwriting challenges, and policy considerations in an evolving energy landscape. Experts emphasized the complexities of securing coverage, particularly as the industry shifts toward renewables.

Risk assessment remains central to underwriting, with insurers evaluating factors such as equipment failures, natural disasters, market volatility, and regulatory changes. Loss history significantly influences policy terms, while compliance challenges and fluctuating energy markets add further complexity. Renewable energy facilities present unique risks, including intermittent generation and evolving standards, requiring insurers to adapt their coverage strategies.

Proactive risk mitigation emerged as a key theme. Insurers are increasingly partnering with plant operators to implement safety protocols, predictive maintenance, and modernization efforts, reducing exposure and improving insurability. Some firms even offer specialized consulting to enhance operational resilience.

Technology is transforming insurance practices, with data analytics and AI improving risk assessment and policy precision. Real-time monitoring allows insurers to adjust coverage based on operational performance, leading to more tailored and cost-effective policies.

Regulatory shifts, geopolitical instability, and supply chain disruptions also impact insurance costs. Insurers must account for third-party vendor reliability, further complicating underwriting decisions. The panel unanimously agreed on the need for closer collaboration between insurers and plant operators, advocating for customized policies that address specific risks rather than reactive loss coverage.

Think outside the turbine

It’s not all about the LM engines at PEC. Several expert-led sessions highlighted critical systems that support power plant operation and provide a robust learning environment for end users. With many sessions to choose from the editors focused on the following to highlight the diversity and depth of content:

- SCR and CO catalyst systems design and optimization

- Filtration solutions for enhanced turbine performance

- Gas turbine synchronous condensing applications

- Optimizing generator life

Get your catalyst right

An educational selective catalytic reduction (SCR) systems session, presented by Jeff Wirt of EnergyLink International and Dan Ott of Environex, dove deep into emissions control solutions. By sharing best practices in system design and maintenance, the experts conveyed an in-depth review of SCR and CO catalyst systems, covering their process, mechanical, controls, and acoustic design.

EnergyLink is a leading provider of air and noise emissions control solutions, gas turbine auxiliary systems, and turnkey buildings. Environex, an independent consulting firm, specializes in SCR and CO catalyst system design, performance optimization, and maintenance services. Together, these companies offer expertise in reducing emissions and improving system efficiencies for power generation and industrial applications.

The design and functionality of SCR systems were explored in detail. The process design ensures optimal gas flow, temperature distribution, and ammonia injection for effective NOx reduction. Mechanical design considerations focus on the durability of catalyst support structures, ensuring long-term performance. Control design integrates PLCs to enable precise emissions management, while acoustic design incorporates silencers, barriers, and insulation to reduce noise pollution.

A key aspect of the session was the discussion on catalyst performance and maintenance. The lifespan of a catalyst ranges from 1,000 to 40,000 hours, depending on system operation. Performance can be impacted by fouling, poisoning from contaminants such as sodium and sulfur, and sintering due to high temperatures. Regular maintenance, including catalyst cleaning, AIG tuning, and root cause analysis, is essential to mitigate these issues and sustain optimal performance.

Limitations and optimization of SCR systems. Ott emphasized that excessive ammonia injection does not necessarily enhance NOx reduction and can lead to ammonia slip. Proper flow distribution and catalyst selection are crucial for maximizing efficiency. Additionally, temperature and residence time play a significant role in NOx conversion, necessitating tailored designs for various gas turbines and industrial applications.

What’s in your filters?

Bob Reinhardt of filter giant Donaldson explored how effective filtration enhances equipment protection, improves efficiency, and reduces maintenance requirements. The discussion revolved around key filtration classifications, the impact of various filter types, and strategies for maintaining optimal filtration performance.

Filtration is essential for safeguarding equipment from contamination, ensuring operational efficiency, and minimizing maintenance costs. Effective filtration protects turbines and compressors from harmful particles, including large debris, fine dust, salt, and chemical contaminants. By reducing the accumulation of these impurities, filtration enhances system efficiency, prolongs equipment life, and ensures reliable operation in diverse environments.

The company employs an Er-W-P classification system to assess filter performance. This system evaluates filtration based on three key metrics: particle removal efficiency (Er), water resistance (W), and pulse cleaning capability (P).

The efficiency rating measures how well a filter captures airborne particulates, helping operators balance performance with cost. The water-tightness rating is particularly relevant in humid or coastal locations, where moisture and salt can accelerate corrosion. Finally, the pulse cleaning rating is crucial for environments exposed to high dust, snow, or ice levels, as it determines the filter’s ability to recover from heavy contamination.

The session also compared different filtration technologies. Standard F8/F9 filters are suitable for moderate contamination levels and require periodic maintenance. In contrast, high-efficiency particulate air (HEPA) E11/E12 filters offer superior performance by employing multi-layered media to trap even the finest particles. These advanced filters provide excellent protection in harsh environments, significantly reducing particulate penetration.

Filtration effectiveness varies based on environmental conditions. For example, in urban areas with an Air Quality Index (AQI) of 50, HEPA filters drastically reduce particulate accumulation compared to standard filters or no filtration at all. In more extreme conditions, such as wildfire-affected areas with an AQI of 150, high-efficiency filters become indispensable for preventing excessive debris from damaging equipment.

Proper maintenance is essential for sustaining filtration performance. Regular inspections, pre-filter replacements, and data-driven monitoring help prevent pressure drops and system inefficiencies. Ensuring that filters are clean and functioning optimally can extend equipment lifespan and reduce operational costs.

Empowering the grid

Morgan Hendry, SSS Clutch Company, presented on the role of gas turbine synchronous condensing applications in modern power grids with emphasis on how synchronous condensers contribute to grid stability, facilitate renewable energy integration, and provide ancillary services through advanced clutch systems.

A synchronous condenser is a specialized machine that connects to an electrical system to either absorb or supply reactive power (VARs), stabilizing voltage levels and restoring power factors. Equipped with an automatic voltage regulator (AVR), these machines adjust excitation levels based on grid conditions, ensuring consistent power quality.

Beyond voltage regulation, synchronous condensers contribute to system inertia and fault current availability—critical elements for maintaining grid stability as the transition to renewable energy reduces traditional sources of inertia.

Synchronous condensers play a vital role in modern energy infrastructure by stabilizing frequency, managing power factor corrections, and supporting voltage levels across transmission networks. They are particularly useful for industrial and urban areas, where power fluctuations can disrupt operations. Additionally, they provide valuable services to long transmission lines and integrate seamlessly with static capacitors. Their flexibility allows participation in ancillary service markets, offering an additional revenue stream for grid operators.

Retrofitting gas turbines with clutches enhances efficiency by reducing mechanical wear and optimizing power consumption during condensing mode. This ensures quick transitions from synchronous condensing to active power generation when needed, increasing system reliability while extending equipment lifespan.

Beyond their operational advantages, synchronous condensers help accelerate the transition to cleaner energy by improving transmission efficiency, providing dynamic reactive power to support renewables. Retrofitting older generators with modern clutch systems is a cost-effective approach, often delivering a return on investment within just a few years.

Don’t forget the generator

The training session on generators, presented by BRUSH Power Generation, a subsidiary of Baker Hughes, provided an in-depth overview of generator technology, maintenance, and best practices for optimizing product life. The speakers emphasized the importance of maintenance, inspections, and operational best practices to extend the lifespan of these critical assets.

The session also addressed generator maintenance and life optimization, emphasizing that BRUSH generators are designed for a lifespan of approximately 30 years, provided they receive proper maintenance. Factors that significantly impact generator longevity include regular inspections, using the correct replacement parts, adhering to proper operational practices, and conducting routine health checks on automatic voltage regulators (AVRs) and protection systems. Contamination from dust, dirt, and moisture was highlighted as a major risk to generator performance, requiring preventative measures to ensure long-term reliability.

A structured maintenance schedule was presented to optimize generator life. Annual inspections or those conducted every 8,000 hours focus on minor checks, while more detailed Level 1 inspections (conducted every 25,000 hours) involve partial disassembly to assess components. Level 2 inspections, occurring every 50,000 hours, include a more thorough examination of bearings and end windings, while Level 3 inspections, performed every 100,000 hours, require full rotor removal and extensive stator testing. Adhering to these maintenance levels is essential for preventing costly failures and extending generator service life.

Poor maintenance and operational errors, such as back-energizing or mal-synchronization, can cause significant damage to the rotor, stator, and insulation systems. Additionally, loss of oil can result in bearing failures, while contamination can degrade insulation and lead to long-term performance issues. Paramount is the importance of proactive monitoring, ensuring spare parts are readily available, and following best practices to prevent these operational risks.

The road forward

State of the PE6000

Rob Andrews, CTO, provided attendees with some exciting news on the performance and continuing development of the PE6000 gas turbine. For those who don’t know, ProEnergy unveiled the 48-MW PE6000 aeroderivative turbine one year prior at PEC2023. The engine is designed for dispatchable power

applications to quickly close the gap between power supply and demand that often occurs during severe weather solar ramp-off, and days with low or limited production from renewables. Each PE6000 begins with a ProEnergy-overhauled engine core from GE’s CF6-80C2, which is found in aircraft including the Boeing 747.

The PE6000 gas turbine has undergone extensive validation to assess its engineering integrity. This process included testing materials, vibration resistance, and overall subsystem performance, as well as comprehensive engine trials both in the field and on test stands.

Two units were put through rigorous operational testing, including hot starts, cold starts, and load rejection scenarios. One unit accumulated 2,300 hours and 400 starts, while another logged 1,000 hours and 150 starts. Following these tests, the first unit was torn down to examine potential failure modes or wear characteristics that might differentiate it from the LM6000.

The results confirmed that no unexpected issues emerged. Similarly, the second unit operated at WattBridge throughout the summer of 2024 before undergoing a teardown, further validating the turbine’s reliability.

The structural integrity of critical components, such as the LPC inlet frame and LPC case, remained intact, with no indications of defects. Vibration levels and tolerances stayed within expected specifications, while starting reliability and overall performance met or even exceeded that of the rest of the WattBridge fleet.

Looking ahead, ProEnergy is advancing the PE6000’s development. Compressor blade reverse engineering is already underway, with testing in progress. The next phase involves HPC blade manufacturing for all stages. Additionally, combustor hardware is currently in the testing phase, with validation scheduled for 2025. The program is also moving forward with manufacturing wheels, blades, and nozzles for the low-pressure turbine (LPT) section, as well as all accessory gearbox components and an improved power augmentation system.

With 10 fully developed PE6000 units and two feasibility units, the turbine is proving its reliability and performance, positioning itself for full-scale deployment in the near future.

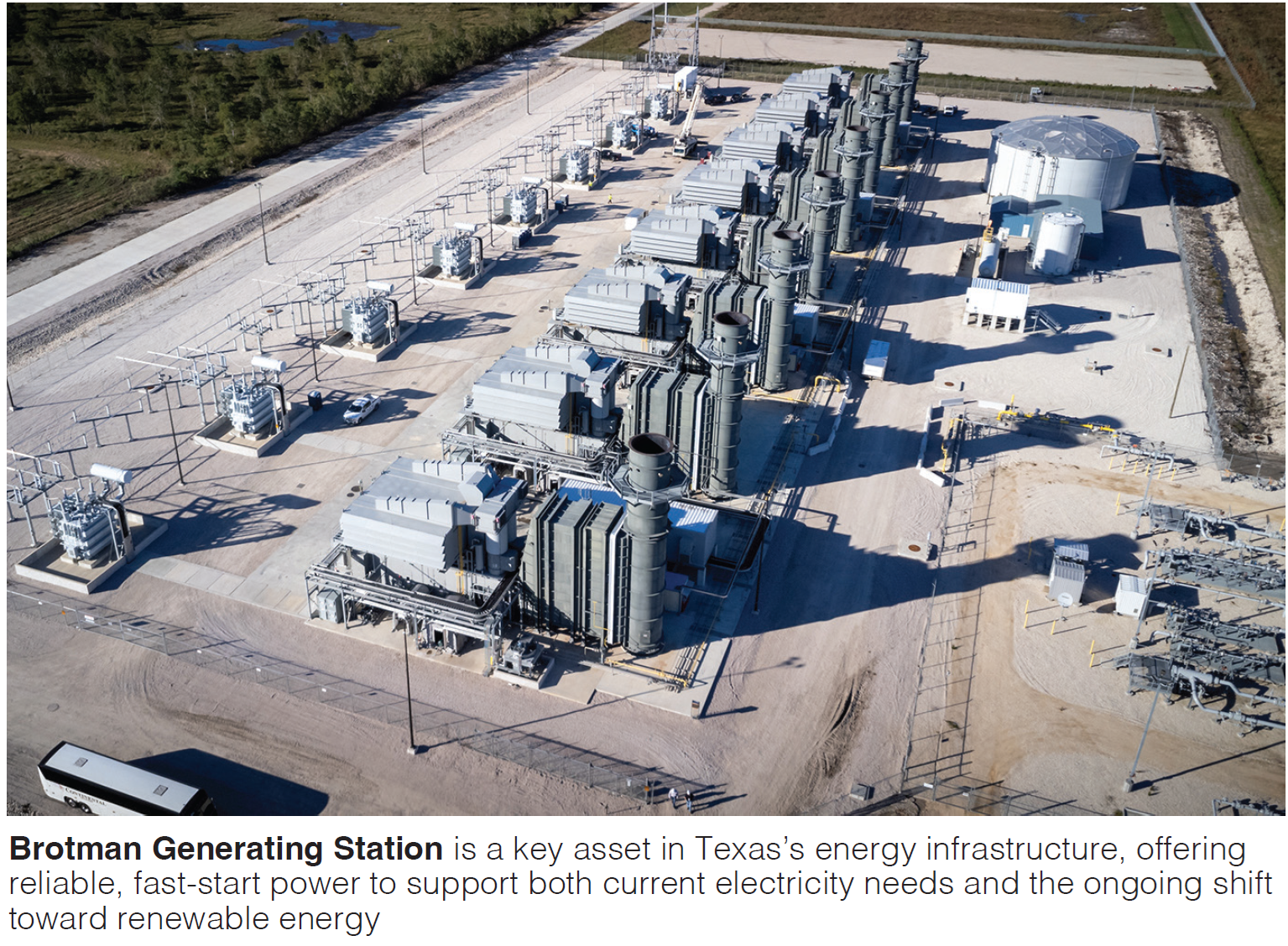

Where the turbines meet the load

To close out the conference, attendees were treated to an O&M best practices plant tour of WattBridge’s Brotman Generating Station, a 384-MW peaking power facility located in Brazoria County, Tex. Commissioned in May 2023, it is equipped with eight ProEnergy LM6000 gas-turbine packages, designed to provide fast-start, reduced-emission power during periods of peak electricity demand.

As you can imagine, countless lessons learned trickle down as dozens upon dozens of turbine packages are manufactured in Sedalia shop, shipped, constructed, commissioned, and operated. ProEnergy holds this continual improvement across the entire value chain as sacred. Guests were afforded the opportunity to see and hear about the evolution of the gas turbine package as design improvements and best practices have been implemented to enhance the operations and maintenance of the entire fleet. CCJ