With the 2023 Power Plant Controls Users Group (PPCUG) approaching August 28-31 in Atlanta, part of the greater Power Users Combined Conference, reviewing some of the content from last year’s meeting should encourage you to attend or send someone from your organization to experience this valuable content in person. Presentation abstracts below are based on information available only to end users in the slide decks posted at www.powerusers.org. Those seeking deeper dives into specific topics should note the presentation titles in italics at the end of each summary and access the source material on the website. See part one of this recap series here.

Differentiate alarm audio tones

Most plants with digital control systems suffer from alarm overload in the control room and have applied better methodologies to reduce the number of alarms, prioritize them, and reduce the burden on operators without sacrificing their attention to the ones that matter. A unique feature of the alarm methodology described here, by a large-fleet user, is applying unique audio tones to indicate alarm priority.

Two real-world examples are included: A generator-field ground-detector test from the human machine interface (HMI) and turbine lube-oil leak detection.

“Alarm Management: Generator FGD Testing, Leak Detection”

OEM versus non-OEM: Get R.E.A.L.

“OEM and non-OEM suppliers are battling these days for the customer, and in some cases are practically giving away the hardware.” So states John Downing from TC&E, a division of AP4 Group, in reviewing the merits of choosing one over the other, mostly illustrated through a series of questions posed to the audience. Four areas—reliability, efficiency, affordability, and longevity (R.E.A.L.)—are explored.

Plan for supply-chain disruptions

During a suite of vendor presentations, two OEMs addressed supply-chain challenges. One said a major chip supplier announced “allocations” around the primary CPU in the family of controllers used in the Mark VIe. The other OEM rep said lead times have been extended by 50% to 100% since 2019, but also implied that the worst was over.

“Our procurement systems were not really that sophisticated,” one presenter admitted, addressing internal supply-chain issues. “We had too many single-source suppliers, poor visibility into sub-sub-suppliers, and no end-to-end forecasting.” This apparently has been rectified, in part through multi-vendor sourcing agreements and digital surveillance capability over sub-suppliers. The only recourse for users has been to postpone obsolescence-related replacements, collaborate more tightly on advance planning for upgrades, and expect and be prepared for controller failures.

OEM presentations are not posted on the Power Users website. To access Siemens-Energy slide decks, write galen.george@siemens-energy.com. For GE, log into your MyDashboard account on the GE website.

Partner with a controls specialist

John Emery, Nexus Controls (currently part of GE Vernova), urged users to consider a partnering arrangement with a controls specialist firm for “fully integrated controls and cybersecurity solutions.” World-class training services, preventive maintenance, remote diagnostics, and even remote service are available, along with in-kind and upgraded components, and advanced software.

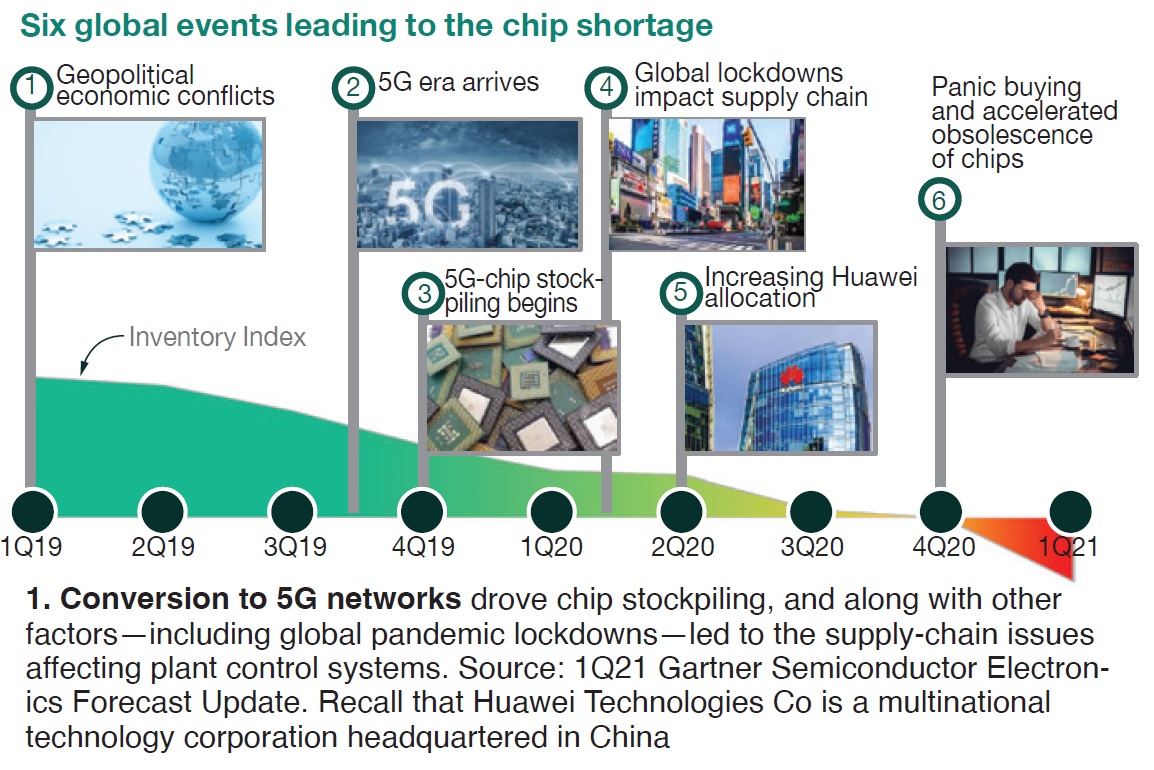

Supply-chain struggles to continue through 2023

Carrying on the prevalent theme from controls OEMs, Jaime Butler, Nexus Controls (currently part of GE Vernova) included a few valuable slides which help explain the supply-chain disruptions most users are experiencing for chips and other electronic components. The global pandemic was only one of the drivers.

Unfortunately, the conclusion is that, while inventory for unconstrained components will continue to build, products dependent on field programmable gateway arrays (FPGA), power management integrated circuits (PMIC), and microcontroller units (MCU) will continue to struggle. Butler suggests several proactive solutions to mitigate risk.