The gas turbine world had to wait until June 22 of the Western Turbine Users Inc’s (WTUI) 2021 virtual conference for the session billed by the independent organization of gas-turbine owner/operators as “Axford & Friends.” But the wait was well worth it. Houston-based Turbine Consultant Mark Axford is a crowd favorite at this meeting, having shared his considerable market and technical knowledge with the group for the last 15 years or so.

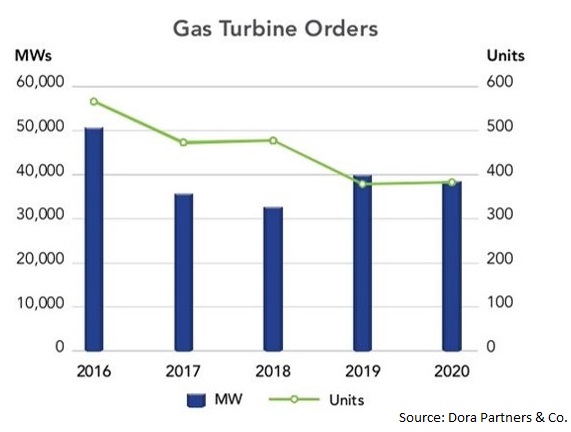

Old Friend Anthony Brough, PE, president, Dora Partners & Co, presented his respected annual analysis of gas-turbine orders, while New Friends Jason Miller, PE, and Erik Youngquist, VP, of GridSME, updated the group on the “State of the Combustion Turbine: A Grid Compliance Perspective,” which focused on the California market so important to the majority of attendees.

After a brief intro by Axford, Brough took over for 20 minutes of gas turbine market data, trends, and analysis. Some key stats from the presentation available for playback below:

-

-

- Since 2012, GT unit orders down 67% and MW orders down 42%

- Aeroderivative orders down in US by 69% but up worldwide 14% in 2020.

-

According to Brough, there are a variety of factors contributing to the GT market decline, outlined here:

-

-

- Dramatic adoption of renewable energy impacts all size ranges of GTs, though the need for renewable offsets will eventually promote GT additions.

- Overbuild of F-technology gas turbines, relegated to peak service. Though all evidence reflects these turbines are now transitioning back to their intended mid-merit and baseload usage. This means deployment of GTs <100MWs in the coming years could see an uptick, though balanced by renewable additions.

- Technology substitution in the <15MW market where reciprocating engines have dramatically overtaken gas turbines due to a much lower acquisition cost and very good fuel efficiency.

- The lack of comprehensive government and regulatory support for combined-cycle plants has stunted the great potential of highly efficient, environmentally friendly GT-based plant development, especially in North America.

-

Axford opened the meat of his presentation with the positive thought that the Covid shock to the global gas-turbine order book was not as bad as had been anticipated (Brough said about 40 GW were ordered in both 2019 and 2020, more than in 2017 and 2018) but the long-term trend is still on downward trajectory. Primary reasons he gave for the decline in orders: regulations, mandates, and subsidies.

Recent impacts of the market decline included the following:

-

-

- Siemens spun off its turbine group a year ago as Siemens Energy.

- GE Oil & Gas is gone, now part of Baker Hughes.

- Pending sale of PSM by Ansaldo Energia to Hanwha.

-

Axford brought the group up to date on renewables, H-class gas turbines, impacts of the Texas storm in February 2021, electric vehicles, battery storage, the outlook for hydrogen, carbon capture, and what life might be like in the post-Covid world. Way too much for a short summary; listen to the nominal 40-minute presentation yourself as time allows.

He closed with three turbine lessons learned over the last couple of years:

-

-

- Be prepared for delays or cancellations of gas-turbine projects—caused, in part, by longer lead times for everything.

- Rethink your parts inventory; focus less on “just in time.”

- Rethink your supply chain: verify vendor inventories, consider the impacts of politics and transport for equipment sourced internationally, think about manufacturing in your home country even if it costs more.

-

Dig into the details provided by Axford and Brough on the aero market by listening to their presentation. They welcome you to contact them with any questions/comments at maxford@axfordconsulting.com and abrough@dorapartners.com.

Miller and Youngquist, engineers for the California-based consultancy GridSME. then covered opportunities and challenges for gas generation, generator testing requirements (including a case study), notes on the August 2020 “heat storm,” system mix changes, etc. Their discussion-style presentation (similar to a radio show on current issues) is interspersed with meaningful Q&A and audience commentary. Watch the replay below.